TECHNOLOGY

Which ETF is Right for You: An In-Depth Look at VUG vs VOO

Looking to invest in ETFs but not sure where to start? Dive into the world of VUG vs VOO with us as we break down these popular options and help you determine which one aligns best with your investment goals. Whether you’re a seasoned investor or just starting out, understanding the differences between these two funds can make a big impact on your portfolio. Let’s explore the nuances of VUG and VOO to see which one suits your financial strategy!

What are ETFs?

ETFs, or Exchange-Traded Funds, are investment funds that trade on stock exchanges. They combine the diversification of mutual funds with the flexibility of individual stocks. ETFs typically track an index, commodity, or a basket of assets. This means you can invest in a wide range of securities through a single fund.

One key benefit of ETFs is their intraday trading feature, allowing investors to buy and sell throughout the trading day at market prices. This differs from mutual funds which are only traded once per day after markets close. Additionally, ETFs often have lower expense ratios compared to mutual funds.

Investors appreciate ETFs for their transparency as holdings are disclosed daily. They offer exposure to various sectors and asset classes without needing to purchase individual securities directly. ETFs provide a cost-effective and convenient way to diversify your portfolio with ease.

Introduction to VUG and VOO

Ever heard of ETFs? If not, don’t worry – I’ve got you covered. Let’s dive into the world of exchange-traded funds and explore two popular options: VUG and VOO.

Vanguard Growth ETF (VUG) focuses on companies with strong growth potential, making it a favorite among investors seeking long-term capital appreciation. On the flip side, Vanguard S&P 500 ETF (VOO) tracks the performance of the S&P 500 index, offering broad exposure to large-cap U.

S. stocks.

Both VUG vs VOO and VOO provide diversification benefits while keeping costs low – a win-win for savvy investors looking to build a balanced portfolio. Whether you’re drawn to growth opportunities or prefer mirroring the broader market, these ETFs offer distinct investment strategies worth considering.

Stay tuned as we delve deeper into the performance comparison and key differences between VUG and VOO in our next blog sections!

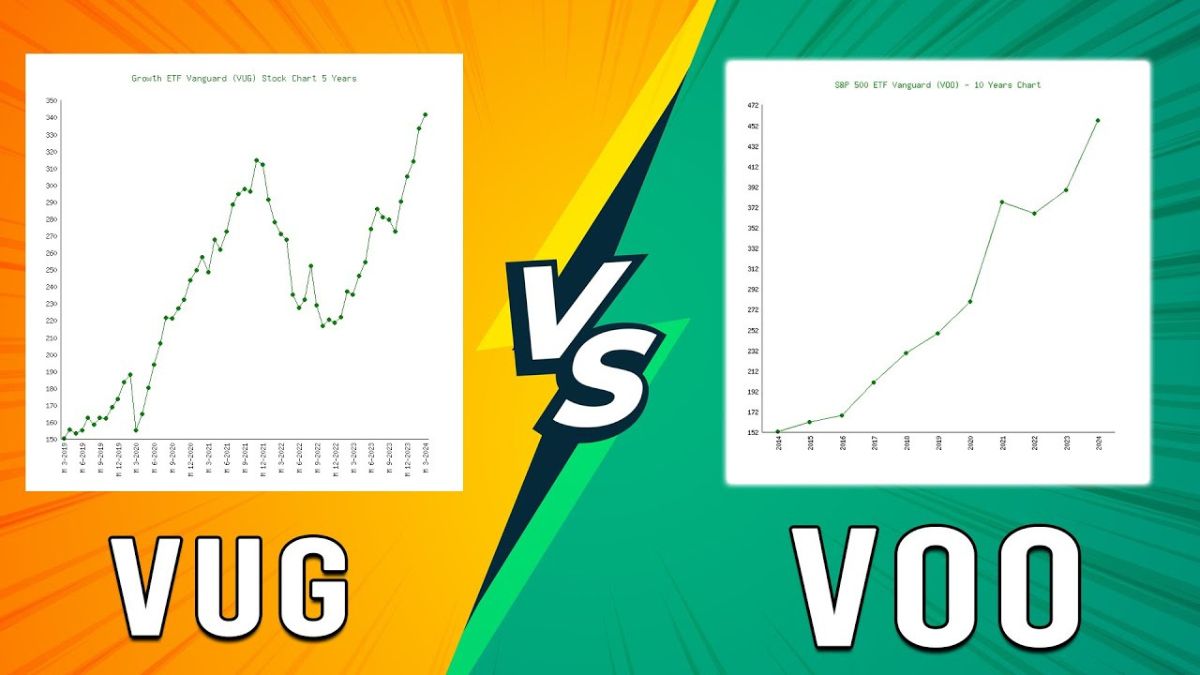

Performance Comparison of VUG and VOO

When it comes to comparing the performance of VUG and VOO, investors often find themselves in a dilemma. Both ETFs have shown strong performance over the years, attracting attention from those seeking growth opportunities in the stock market.

VUG, Vanguard Growth ETF, focuses on companies with high growth potential, while VOO, Vanguard S&P 500 ETF, tracks the performance of the S&P 500 index. This fundamental difference in their investment strategies leads to varying returns based on market conditions and economic factors.

Historically, VUG has outperformed VOO during bull markets due to its emphasis on growth stocks. On the other hand, VOO provides more stability during market downturns as it includes established companies across various sectors.

Understanding your risk tolerance and investment goals is crucial when deciding between VUG and VOO. Conducting thorough research and consulting with financial advisors can help you make an informed decision that aligns with your portfolio objectives.

Key Differences Between VUG and VOO

VUG and VOO may seem similar at first glance, both being ETFs tracking large-cap U.

S. stocks. However, diving deeper reveals key differences that can impact your investment strategy.

One major difference lies in their holdings: VUG focuses on growth-oriented companies with strong potential for earnings expansion, while VOO tracks the performance of the S&P 500 Index, representing a broader spectrum of large-cap stocks.

Another distinction is in their expense ratios – VUG vs VOO tends to have a slightly higher expense ratio compared to VOO, which might influence cost-conscious investors’ decisions.

Furthermore, their sector allocations vary; VUG has a tilt towards technology and consumer discretionary sectors, whereas VOO offers more diversified exposure across multiple industries within the S&P 500 Index.

Considering these factors alongside your investment objectives is crucial in determining which ETF aligns best with your financial goals.

Factors to Consider When Choosing Between VUG and VOO

When choosing between VUG vs VOO and VOO, it’s crucial to consider your investment goals. Are you looking for growth or stability? VUG focuses on companies with high growth potential, while VOO tracks the performance of the S&P 500.

Another factor to weigh is expense ratios. VUG has a slightly higher expense ratio than VOO, which can impact your overall returns over time. Consider the fees associated with each ETF before making a decision.

Diversification is key when building a well-rounded portfolio. Take into account the sectors and industries each ETF is exposed to. VUG leans towards technology and consumer discretionary stocks, whereas VOO provides exposure to various sectors.

Think about your risk tolerance. High-growth stocks in VUG may come with increased volatility compared to the stability offered by large-cap companies in VOO. Evaluate how much risk you’re comfortable with before selecting the right ETF for your needs.

How to Decide Which ETF is Right for You

When it comes to deciding which ETF is right for you, there are several factors to consider. One key aspect to evaluate is your investment goals and risk tolerance. Are you looking for long-term growth or stable returns? Understanding your financial objectives will help guide your decision between VUG and VOO.

Another important factor to weigh is the expense ratio of each ETF. Lower fees can significantly impact your overall returns over time. Additionally, take into account the underlying holdings of VUG and VOO. Do their respective portfolios align with industries or sectors you believe in?

Consider the historical performance of both ETFs as well. Analyzing how they have fared during various market conditions can provide insights into potential future outcomes. Think about liquidity – how easily can you buy or sell shares of VUG or VOO when needed?

By carefully assessing these aspects and doing thorough research, you can determine which ETF aligns best with your investment strategy and financial aspirations.

Conclusion:

Deciding between VUG vs VOO and VOO ultimately comes down to your investment goals. If you’re seeking growth through exposure to large-cap companies with strong growth potential, then VUG may be the better choice for you. On the other hand, if you prefer a more diversified approach that tracks the performance of the overall market, then VOO could be the right fit.

Before making a decision, carefully consider factors such as expense ratios, holdings, performance history, and risk tolerance. It’s essential to align your investment strategy with your financial objectives and timeline.

Remember that investing always carries inherent risks, so it’s crucial to do thorough research and consult with a financial advisor if needed. By understanding your goals and assessing these ETFs’ attributes in line with them, you can make an informed decision that best suits your unique investment needs.

Whichever ETF you choose – whether it’s VUG vs VOO or VOO – stay focused on your long-term objectives and remain patient during market fluctuations. Happy investing!

TECHNOLOGY

The Power of Cradible in the Digital Age

In today’s fast-paced digital world, establishing trust and credibility is more crucial than ever. Whether you’re a seasoned entrepreneur or an up-and-coming influencer, your reputation can make or break your success. Enter “Cradible”—a concept that encompasses both ‘credibility’ and ‘ability.’ This blog post will guide you through understanding what Cradible means, how it influences your personal and professional life, and ways to enhance it for greater success.

What is Cradible?

Cradible is a blend of two essential qualities—credibility and ability. These traits together form the backbone of trustworthiness in any professional field. Credibility refers to how believable and reliable someone is, usually based on past actions, qualifications, and integrity. Ability, on the other hand, is about having the skills and competencies to perform tasks effectively.

To be considered Cradible, one must not only possess the necessary skills but also demonstrate them in a trustworthy manner. This combination assures others that you are not only capable but also honest and ethical in your dealings. In an interconnected world where misinformation and deceit can easily spread, being Cradible helps you stand out as a beacon of dependability.

The Importance of Being Cradible

In a digital era where anyone can publish anything online, distinguishing truth from falsehood can be challenging. For this reason, being Cradible has become a vital asset. Whether you’re selling a product, providing a service, or delivering information, people need to trust that you’re delivering on your promises. Without credibility, your ability, no matter how great, might go unnoticed.

Businesses and individuals who are Cradible tend to foster stronger relationships with their audiences. They are more likely to enjoy repeat customers, gain referrals, and receive positive word-of-mouth. In turn, this trust can enhance customer loyalty and brand reputation. Being Cradible can set you apart from competitors and create a lasting impression on those you serve.

Building Trust Through Cradibility

Achieving Cradibility involves more than just a single action; it’s about consistent behavior over time. Being transparent about your intentions and openly communicating with your audience are crucial first steps. People need to believe that you’re straightforward and have nothing to hide.

Next, delivering high-quality goods and services consistently will reinforce your ability and reliability. Meeting or exceeding expectations shows that you are dependable and committed to excellence. Positive testimonials and reviews from satisfied clients can further bolster your credibility.

Finally, demonstrate your expertise by sharing valuable insights and knowledge. This could be through blog posts, webinars, or social media platforms. When you offer useful information without expecting anything in return, you establish yourself as an authority in your field, which enhances your perceived Cradibility.

The Role of Cradibility in Marketing

In marketing, Cradibility is an invaluable tool. Consumers today are inundated with advertisements and promotions, making them cautious and discerning. To capture their attention and earn their trust, marketers need to utilize Cradible strategies.

Authentic storytelling is one such strategy. Sharing real stories and experiences that reflect your brand’s values can resonate deeply with audiences, building an emotional connection. Furthermore, collaborating with trusted influencers can lend some of their credibility to your brand and help reach prospective customers.

Transparency in marketing efforts is also critical. Clearly communicate what your products or services can do and avoid making exaggerated claims. When customers see a brand as honest and reliable, they are more likely to engage positively and make informed purchasing decisions.

Cradibility in Leadership

For leaders, being Cradible is essential for inspiring and guiding teams. Employees look up to leaders who exhibit both competence and integrity. When a leader is Cradible, team members feel more confident in their direction and are motivated to follow their lead.

Effective leaders model Cradible behavior by being accountable and owning up to mistakes. They also empower their teams by fostering open communication and encouraging feedback. This creates a work environment built on trust, where everyone feels valued and respected.

Additionally, Cradible leaders are continuous learners. They invest time in enhancing their skills and knowledge, demonstrating that they are committed to their growth and the growth of their team. This ongoing development underscores their ability and commitment to excellence.

Enhancing Personal Cradibility

Your Cradibility extends beyond professional realms—it’s vital in personal interactions too. Start by being true to your word. Keeping promises and commitments reinforces your trustworthiness. Even small gestures of reliability, like punctuality, can significantly impact how others perceive you.

Being authentic and genuine in your interactions is equally important. People appreciate honesty, even when it involves admitting a lack of knowledge or a mistake. Vulnerability can strengthen relationships by fostering a sense of mutual respect and understanding.

Lastly, practice active listening. Show that you value others’ opinions and perspectives by giving them your full attention. When people feel heard, they are more likely to trust and respect you, strengthening your Cradibility in personal connections.

Cradibility in Customer Service

Customer service is a frontline representation of your brand, making Cradibility crucial in this area. Customers want to interact with representatives who are knowledgeable, empathetic, and genuinely eager to help.

Providing excellent customer service starts with effective training. Equip your team with the skills and resources they need to address customer inquiries accurately and efficiently. Encourage them to be patient listeners and problem-solvers who prioritize the customer’s needs.

Additionally, soliciting feedback from customers shows that you value their input and are committed to improvement. Implementing their suggestions can lead to enhanced service and increased satisfaction, reinforcing your brand’s reliability.

Leveraging Cradibility in Content Creation

Content creators can greatly benefit from being Cradible. With so much content available online, audiences seek creators they can trust for accurate and insightful information. Start by thoroughly researching your topics and ensuring that facts are substantiated by credible sources.

Consistency is key. Regularly publishing high-quality content builds a loyal audience that anticipates your updates. Engage with your audience by responding to comments and questions, showing that you care about their thoughts and experiences.

Creative storytelling is another powerful way to showcase Cradibility in content creation. Share personal anecdotes and real-life examples that support your message and resonate with your audience. This emotional connection can enhance your credibility and foster a sense of community among your followers.

Cradibility in Networking

Networking is an essential aspect of professional growth, and being Cradible can significantly impact your success. When meeting new people, whether in person or online, first impressions matter. Present yourself confidently and authentically, showcasing both your abilities and your integrity.

Follow through on your commitments, such as attending events or meetings you agreed to. Reliability builds trust and respect among your network, making individuals more likely to recommend you for opportunities.

Finally, give as much as you receive. Share your knowledge, resources, and connections generously. Helping others succeed not only strengthens relationships but also enhances your reputation as a Cradible professional.

Cradibility in Social Media

Social media platforms offer a unique opportunity to establish and showcase your Cradibility. Begin by being transparent about your intentions and maintaining consistency with your brand’s values across all platforms.

Engage authentically with your followers by responding to comments and messages promptly. Show appreciation for their support and encourage meaningful discussions. Sharing behind-the-scenes content or personal stories can also humanize your brand, making it more relatable and trustworthy.

Furthermore, collaborate with other credible influencers or brands to expand your reach and share their audience’s trust. By aligning with those who share your values, you reinforce your Cradibility and attract loyal followers.

Creating a Culture of Cradibility

Incorporating Cradibility into your organization’s culture can lead to long-term success. Start by setting clear expectations and guidelines that emphasize the importance of trust and integrity. Provide training and resources to help employees embody these values in their work.

Recognize and reward employees who consistently demonstrate Cradible behavior. This not only motivates individuals but also sets a standard for others to follow. Encouraging transparency and open communication in all aspects of the business reinforces a Cradible culture.

Additionally, lead by example. When leadership models Cradibility, it inspires the entire organization to do the same, creating a cohesive and trustworthy environment that benefits both employees and customers.

Conclusion

In the digital age, being Cradible is more important than ever. From businesses to individuals, the combination of credibility and ability sets you apart and fosters trust among your audience. By consistently demonstrating these qualities in your actions, communications, and relationships, you build a solid foundation for success.

Whether you’re striving for professional growth, enhancing customer service, or building a personal brand, prioritize Cradibility at every step of your journey. Not only will this strengthen your reputation, but it will also create lasting connections and opportunities for growth in an ever-evolving digital world.

TECHNOLOGY

Diving Into the Latest With Newztalkies

In a world brimming with information, staying up-to-date with the latest happenings across various fields can be a daunting task. That’s where Newztalkies.com steps in, offering a diverse range of content that keeps readers informed and entertained. Whether you’re keen on technology, fascinated by history, or looking for practical tips, Newztalkies.com has something for everyone. In this blog post, we’ll take you through what makes Newztalkies.com a go-to source for news and insights.

The Allure of Technology News

Technology is an ever-evolving landscape that influences every aspect of our lives. Newztalkies.com recognizes this and provides readers with the latest tech news and trends. From groundbreaking innovations to practical tech tips, the site ensures you stay ahead of the curve.

For instance, one might find articles on AI advancements, like AI headshot generators that reshape online identities. These tools help users present themselves professionally on digital platforms, ensuring their online personas reflect who they truly are.

Exploring Urban Living and Pest Control

Living in vibrant cities has its perks, but it comes with challenges too, like pest control. Newztalkies.com offers guides on managing urban pests, highlighting strategies tailored to specific cities like Perth and Adelaide. These articles provide homeowners with essential tips to maintain safe and healthy living environments, addressing common issues like ants and cockroaches.

For example, readers get insights into why regular inspections are crucial in cities with varying climates, ensuring homes are safeguarded year-round.

A Journey Through History with the Samurai Sword

For history enthusiasts, Newztalkies.com dives into intriguing topics like the samurai sword, or katana. This weapon isn’t just a tool of war; it’s a symbol of honor and craftsmanship. Articles explore the katana’s cultural significance, design, and the artisans who craft these masterpieces, offering readers a rich understanding of its place in history.

By engaging with such content, readers can immerse themselves in the rich tapestry of history, gaining perspectives that are both educational and captivating.

The Art of Storytelling in Modern Journalism

The way we consume news has transformed. Newztalkies.com emphasizes the power of storytelling in journalism, presenting news in a format that’s engaging and relatable. This approach helps readers connect with stories on a personal level, making the information memorable and impactful.

Take, for instance, features on interactive storytelling—these pieces highlight how technology merges with journalism to create immersive experiences, drawing readers into the narrative like never before.

Navigating DIY and Home Improvement

Practical advice is invaluable, and Newztalkies.com excels at providing readers with actionable tips. Whether it’s basement waterproofing to prevent water damage or gutter maintenance to keep homes safe, the platform offers comprehensive guides that empower readers to tackle home improvement projects with confidence.

Such articles not only educate but also inspire readers to take proactive steps in maintaining their homes, ensuring safety and efficiency.

Engaging Content Across Diverse Topics

Beyond the core categories, Newztalkies.com covers a wide array of subjects, ensuring there’s something for everyone. From the latest sports entertainment updates to exploring social media trends with guides like MakeMeFamous Australia, the site caters to diverse interests, keeping readers engaged and informed.

For instance, sports fans can find recaps and highlights, while those interested in social media growth can learn strategies to boost their online presence.

Focusing on SEO and Visibility

To reach a wider audience, Newztalkies.com employs SEO strategies that enhance content visibility. Articles are peppered with relevant keywords naturally, ensuring they rank well in search engine results without compromising readability.

This strategic approach not only drives traffic but also ensures that readers find the content they’re interested in easily, enhancing their overall experience.

The Impact of Reader Engagement

Reader engagement is at the heart of Newztalkies.com’s success. By inviting readers to comment and share their thoughts, the platform fosters a sense of community. This interaction enriches the content, as diverse perspectives contribute to a more comprehensive discussion.

Engaged readers are more likely to return, creating a loyal audience base that values the insights and information provided.

Staying Ahead with Regular Updates

Frequent updates ensure that Newztalkies.com remains a reliable source for timely news and insights. Readers can count on fresh content that reflects the latest trends and information, keeping them informed about developments as they happen.

This commitment to regular updates reinforces the site’s position as a go-to resource for news and knowledge.

Conclusion

Newztalkies.com stands out as a multifaceted platform that caters to a wide range of interests. By offering engaging, informative, and well-researched content, it ensures that readers stay informed and entertained. Whether you’re passionate about technology, history, or home improvement, there’s something here for you.

For those eager to explore more, consider bookmarking Newztalkies.com as your daily source of diverse news and insights. You’ll be joining a community of curious minds, all seeking to stay informed in a rapidly changing world.

TECHNOLOGY

The Future of AI Evolution: What Lies Ahead?

Artificial Intelligence (AI) has rapidly transitioned from a subject of theoretical discussion to a key driver in technological advancement across various sectors. Yet, as we stand at the cusp of a new era in AI, it is crucial to consider how this technology will continue to evolve and what trends will shape its future.

Key Trends in AI Evolution

Enhanced Human-AI Collaboration

The future of AI promises to blur the boundaries between human and machine capabilities. We will see more sophisticated AI systems that can complement human intelligence, enhancing productivity and creativity in ways previously unimaginable. This collaboration is likely to extend to various domains, including healthcare, education, and creative industries, where AI will assist in decision-making processes while humans provide the critical oversight and intuition.

Advancements in Natural Language Processing (NLP)

Natural Language Processing will continue to evolve, leading to AI systems that can understand and generate human language with greater nuance and context. This will not only improve virtual assistants and chatbots but also revolutionize how businesses interact with customers, making these interactions more personalized and efficient. Future NLP advancements will likely enable AI to engage in conversations that are indistinguishable from those with humans.

AI in Edge Computing

As devices become smarter, there’s a growing trend towards processing data closer to its source, known as edge computing. AI will play a pivotal role in this domain by enabling real-time data processing and decision-making at the device level. This shift will be particularly beneficial for IoT applications, where timely insights from data are paramount for performance and innovation.

Ethical AI and Governance

With great power comes great responsibility. The evolution of AI necessitates a parallel evolution in ethical guidelines and governance. There will be increased focus on developing frameworks to ensure AI systems are transparent, fair, and accountable. Addressing concerns such as bias, privacy, and security will be crucial as AI becomes more integrated into our daily lives.

AI and the Workforce

The impact of AI on the workforce is a subject of both concern and opportunity. While automation may replace certain jobs, it will also create new roles that require advanced skills in AI management and development. Preparing the workforce for this transition will be essential, highlighting the need for education systems to adapt and focus on AI literacy and reskilling initiatives.

Personalization and Predictive Analytics

AI will bring unprecedented levels of personalization and predictive analytics, transforming how businesses engage with consumers. By analyzing vast amounts of data, AI can anticipate customer needs and preferences, allowing for tailored experiences and proactive solutions. This trend will enhance customer loyalty and drive business growth through more effective marketing and customer service strategies.

Conclusion

The future of AI is poised to bring about significant changes across all aspects of society. By understanding and harnessing these trends, businesses, governments, and individuals can prepare for an AI-driven world that promises efficiency, innovation, and improved quality of life. However, along with these benefits, it is crucial to address the challenges and ethical considerations that come with AI’s evolution to ensure a future that benefits all.

AI evolution is not just about technology—it’s about the collective potential of humans and machines working together to create a better tomorrow. By anticipating these trends, we can better position ourselves to take advantage of AI’s transformative power.

-

FOOD9 months ago

FOOD9 months agoSure! Here are seven engaging blog post titles related to the concept of a “retail food product

-

GENERAL8 months ago

GENERAL8 months agoTroubleshooting Common VRChat Login Issues: Tips and Tricks

-

INSURANCE7 months ago

INSURANCE7 months agoNavigating the Future of Insurance with Technical Reserves in Flow Insurance

-

TECH8 months ago

TECH8 months agoDiscover Reliable Abithelp Contact Solutions with JustAnswer

-

GENERAL9 months ago

GENERAL9 months agoExploring the World of Erothots: What You Need to Know

-

TECH3 months ago

TECH3 months agoWhat You Need to Know About the 346 Area Code

-

Codes3 months ago

Codes3 months agoWhat You Need to Know About the 904 Area Code

-

FOOD9 months ago

FOOD9 months agoSure! Here are seven engaging blog post titles related to a “502 food blog