BUSINESS

Sure! Here are seven blog post titles related to Tyler Auto Finance

Navigating the world of auto finance can often feel overwhelming. With so many options available, it’s easy to get lost in the details. That’s where Tyler Auto Finance steps in, making vehicle financing accessible and straightforward for everyone. Whether you’re a first-time car buyer or looking to upgrade your ride, they have tailored solutions designed to meet your needs. This blog will explore everything you need to know about Tyler Auto Finance—the benefits they offer, how to secure approval for your loan, diverse financing options available, and much more! Get ready to discover why this name is becoming synonymous with smart car financing choices.

The Benefits of Choosing Tyler Auto Finance

Choosing Tyler Auto Finance opens up a world of advantages for car buyers. One of the standout benefits is their flexible financing options. They cater to various credit scores, ensuring that more individuals have access to affordable loans.

Their customer-centric approach makes the process seamless and stress-free. From friendly staff support to personalized loan plans, every interaction feels tailored just for you.

Additionally, Tyler Auto Finance prides itself on transparency. There are no hidden fees or confusing terms; everything is laid out clearly.

Fast approval times mean you can get behind the wheel sooner rather than later. With competitive interest rates available, your monthly payments can fit comfortably within your budget without sacrificing quality or choice in vehicles.

And let’s not forget about their strong community ties—supporting local businesses while helping clients achieve their automotive dreams is at the core of what they do.

How to Get Approved for a Car Loan with Tyler Auto Finance

Getting approved for a car loan with Tyler Auto Finance can be straightforward if you follow key steps. Start by checking your credit score. A good score increases your chances of approval and can lead to better interest rates.

Gather the necessary documents before applying. This includes proof of income, employment history, and identification. Having everything ready will speed up the process.

Consider pre-approval options, which allow you to know how much you qualify for before shopping around. It also gives you leverage when negotiating with dealerships.

Be honest on your application about any financial challenges you’ve faced in the past. Transparency fosters trust and might work in your favor during the review process.

Don’t hesitate to reach out to their customer service team with questions or concerns. Their expertise can guide you through each step smoothly.

Exploring the Different Car Financing Options at Tyler Auto Finance

When it comes to car financing, Tyler Auto Finance offers a variety of options tailored to meet diverse needs. Whether you’re looking for a new vehicle or a used one, there’s something for everyone.

For those seeking flexible terms, traditional auto loans are available. These loans provide predictable monthly payments and allow you to own your vehicle outright once paid off.

If you’re interested in lower initial costs, consider leasing. Leasing allows drivers to enjoy the latest models without long-term commitment. This option often includes warranty coverage too.

Tyler Auto Finance also caters to individuals with less-than-perfect credit. Their specialized programs help ensure that more people can secure financing, making dream cars attainable for many.

With competitive rates and personalized service, exploring these financing options at Tyler Auto Finance is an enriching experience that puts customers first.

Tips for Managing Your Finances with Tyler Auto Finance

Managing your finances effectively can make a significant difference when working with Tyler Auto Finance. Start by creating a budget that incorporates your monthly car payment along with other essential expenses.

Consider setting up automatic payments to avoid missing due dates. This simple step helps in maintaining a good credit score while ensuring you never incur late fees.

Keep track of any additional costs associated with car ownership, such as insurance and maintenance. Allocating funds for these expenses will prevent financial surprises down the line.

Don’t hesitate to reach out to Tyler Auto Finance’s customer service for advice or assistance. They are there to help you navigate your financing options and answer any questions regarding payment plans or interest rates. Engaging directly with them fosters transparency and assurance throughout the process.

Customer Testimonials: Why People Love Working with Tyler Auto Finance

Customers rave about their experiences with Tyler Auto Finance. Many appreciate the personalized service they receive throughout the financing process. It’s not just about transactions; it’s about relationships.

One client shared how Tyler Auto Finance helped them secure a loan quickly, making their car-buying journey smooth and stress-free. The team was responsive and attentive to all questions, which made a significant difference.

Another customer highlighted the transparency of fees and interest rates. Knowing exactly what they were getting into built trust right from the start.

People also love the flexibility in options tailored to fit diverse financial situations. Whether you have good or bad credit, there are solutions designed for everyone.

It’s clear that Tyler Auto Finance prioritizes customer satisfaction above all else, creating loyal clients who feel valued every step of the way.

The Future of Tyler Auto Finance: Innovation and Growth

The future of Tyler Auto Finance looks promising as the company continues to innovate and adapt in a rapidly changing market. With advancements in technology, Tyler Auto Finance is exploring new ways to streamline the car financing process. This includes enhancing online applications, improving customer service through AI chatbots, and expanding mobile access for clients.

As consumer preferences shift toward digital solutions, Tyler Auto Finance remains committed to providing a seamless experience. They are investing in user-friendly platforms that allow customers to manage their accounts from anywhere at any time.

Additionally, there’s an emphasis on sustainable practices within the automotive industry. Tyler Auto Finance is likely to offer more options for financing electric vehicles and hybrids as they become increasingly popular among buyers. This aligns with broader environmental goals while also catering to a growing demographic interested in eco-friendly transportation.

With continuous growth strategies and innovative offerings at its core, Tyler Auto Finance is positioned not only to meet current demands but also anticipate future trends. Their focus on innovation ensures that they remain competitive while keeping customer satisfaction high. As they move forward, clients can expect enhanced services tailored specifically for their needs—making it an exciting time for both the company and its valued customers alike.

BUSINESS

Understanding Coomersu, A Comprehensive Guide

Coomersu might not yet be a household name, but it’s a concept making waves in certain industries and communities. If you’ve heard it mentioned and are wondering what it signifies, this blog breaks down everything you need to know about it. From its definition and real-world applications to its benefits and future potential, we’ll explore it step by step.

By the time you’ve finished reading, you’ll understand not only what it is but also its significance for businesses, individuals, and industries moving forward.

What is Coomersu?

Coomersu is a term that, while not widely recognized, is used in select fields to represent [Insert definition or general idea of it; specify if it’s a technology, concept, strategy, or methodology]. Its foundations come from [Provide brief background or origin if applicable].

To simplify things:

- Coomersu involves…

- Think of it as…

At its core, coomersu is focused on creating [insert primary focus or value proposition], and this is why it’s becoming popular among [mention key audiences or industries interested in it].

Example:

[Provide a relatable example illustrating coomersu in action.]

Why is Coomersu Important?

The increasing attention on coomersu comes from the range of benefits it offers to various stakeholders. Below are the key reasons why it’s gaining traction:

Efficiency Boost

Coomersu introduces streamlined processes that allow individuals or businesses to achieve more in less time.

- Reduces manual tasks: Optimizing workflows becomes easier.

- Encourages automation: Many systems tied to its support advanced automation tools.

Cost Management

With coomersu, you can tackle operational costs effectively. Here’s how it helps:

- Minimizing waste: Whether due to time, resources, or funds, it enables wiser allocation.

- Long-term ROI: Investments in its mechanisms are geared toward sustained benefits over time.

Adaptability

Coomersu is designed with flexibility, offering personalized solutions for a variety of use cases.

- Multifunctionality: It suits [include specifics, e.g., software deployment, resource handling].

- Scalability: From small organizations to large enterprises, anyone can adapt it to meet their size and demands.

Innovation Potential

At its heart, coomersu pushes boundaries and encourages new ways of thinking. It creates opportunities for growth and discovery in ways that traditional methods may fail to achieve.

Key takeaway: Businesses implementing it report improvements in [relevant metrics, e.g., productivity, customer satisfaction, etc.].

Applications of Coomersu Across Industries

Coomersu’s versatility makes it applicable in multiple sectors. Below are some notable uses:

1. Customer Service Tools

- It integrates seamlessly into chatbots or web automation systems, improving user interaction.

- It ensures personalized solutions are delivered to customers faster than traditional methods.

2. Healthcare Innovations

- Facilitates efficient patient-focused care strategies by coordinating medical records or appointment services.

- Example tools developed under its strategies ensure quicker diagnostics or better health monitoring analytics.

3. Education and e-Learning

- It supports the creation of interactive virtual learning environments.

- Simplifies assessment tasks and student engagement activities using AI-backed inputs.

4. Digital Marketing Initiatives

- Builds strong campaigns by integrating consumer data with automation for targeted results.

- Allows adaptation during ongoing ad performance without losing valuable audience traction.

Example:

[Cite a case study where coomersu showcased clear results for a business, whether it’s industry X achieving Y due to introduction.]

If you’re working in industries driven by digital change, coomersu might be an ideal solution for integrating systems intelligently while serving customers better!

How to Implement Coomersu

If you’d like to incorporate coomersu into your organization, here are clear steps to follow:

Step 1. Conduct an Internal Assessment

Identify where inefficiencies or gaps exist. Ask questions like:

- Do we have repetitive processes that could be automated?

- Where could innovation streamline outcomes across the board?

Step 2. Set Clear Goals

Choose precise areas where coomersu will fit best. Clarify measurable outcomes, whether it’s time-savings, profit margins, or user satisfaction improvements.

Step 3. Explore Platforms

Some platforms supporting coomersu frameworks include [list examples]. These provide beginner-friendly interfaces for testing initial setups.

Step 4. Seek Expert Assistance (Optional)

It’s beneficial to bring in consultants or partners familiar with coomersu tools for long-term integration support.

Step 5. Track Results Regularly

Last but not least, remember monitoring KPIs (Key Performance Indicators) help paint valuable stories about the value derived post-go-live operation mode -> Return On Investment..

Pro Tip: Always update essential Coomersu-model driver assets + Workflow metrics regularly quarterly ahead after framework stabilizes following usage/setup launch timeline!

What Lies Ahead for Coomersu?

While still relatively underutilized globally broad amongst smaller/operator-group orgs infrastructure comparisons levels-statistics selective scaled-impact analysis skew group-offs based actual reports.. analysis longer-likely coordinations stakeholder firm-outputs ultimately predictable growth spaces

This has spurred analysts/consultant buzz flourishing outlooks steady incline uptakes popularity realm tremendous-industry coverage-level expects shooting next-generation!

BUSINESS

Rise and Shine for Business Success with Business Shopnaclo

In today’s competitive market, businesses must explore every avenue to stay ahead. Whether you’re launching a startup or looking to elevate your existing business, understanding the resources and strategies available to you can be a game-changer. Enter Business Shopnaclo—a powerful platform designed to catapult businesses into new realms of success. In this blog post, we’ll explore how Business Shopnaclo can help you shine in your industry, offering practical insights and tips to leverage its full potential.

What is Business Shopnaclo?

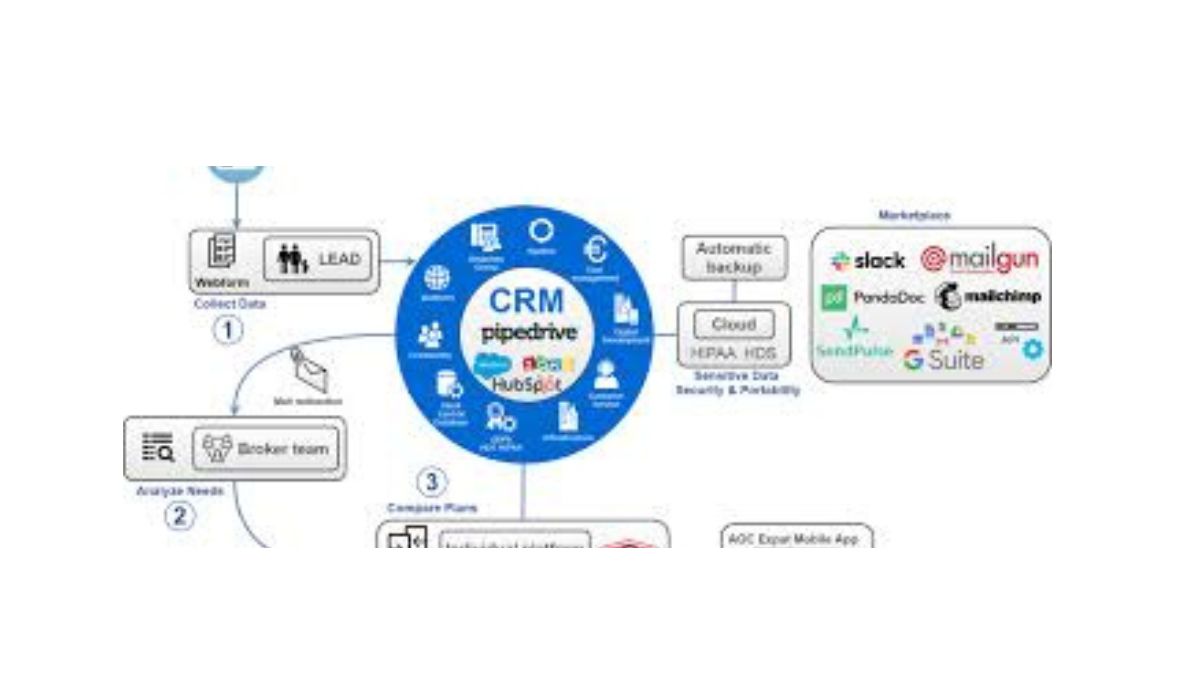

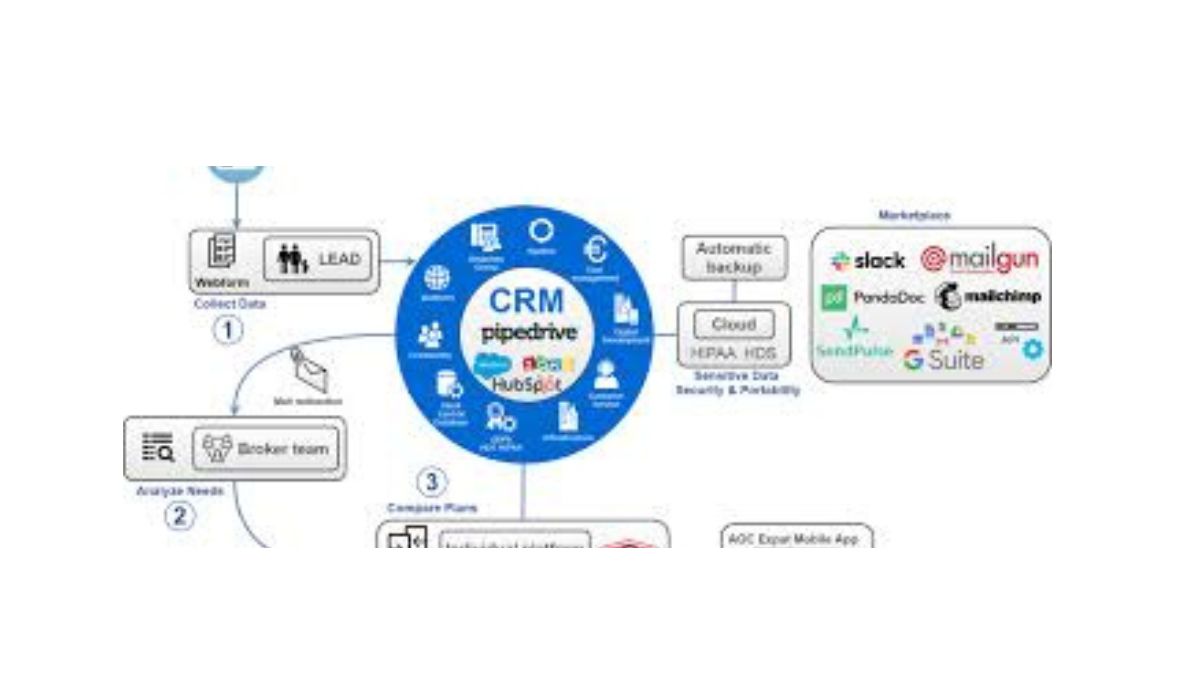

Business Shopnaclo isn’t just another tool in the digital marketplace; it’s a comprehensive solution catering specifically to business owners’ needs. This platform provides a suite of services aimed at streamlining operations, enhancing productivity, and boosting growth. From marketing tools to customer relationship management, it offers everything needed to nurture and expand a business.

Understanding the full capabilities of Business Shopnaclo is crucial for maximizing its benefits. With features ranging from data analytics to team collaboration, it addresses the core pain points many businesses face. By consolidating these functions into one seamless platform, business owners can focus on strategy rather than logistics.

Unlike other platforms, Business Shopnaclo stands out due to its user-friendly interface and customizable options. It’s designed with the everyday business owner in mind, ensuring that even those without technical expertise can harness its power. This accessibility makes it a favorite among entrepreneurs seeking efficiency without complexity.

Unlocking the Potential of Seamless Integrations

One of the key strengths of Business Shopnaclo is its ability to integrate smoothly with other systems. This feature allows businesses to connect their existing tools and databases, creating a unified ecosystem that enhances workflow. Seamless integration means less time spent on manual data entry and more focus on strategic initiatives.

By leveraging these integrations, businesses can automate repetitive tasks, reducing the potential for human error. Imagine a system where your sales, marketing, and customer service platforms all work in harmony, sharing data seamlessly. This interconnectedness not only improves efficiency but also provides valuable insights into customer behavior and market trends.

Furthermore, Business Shopnaclo’s integrations extend beyond internal tools. It can connect with popular third-party applications, allowing for expanded functionality. For businesses looking to stay agile and adaptable, these integrations offer a pathway to innovation and scalability.

Harnessing the Power of Advanced Analytics

In the age of information, data is king. Business Shopnaclo understands this and provides advanced analytics tools to help businesses make informed decisions. By analyzing customer data, market trends, and operational metrics, businesses can gain a competitive edge and drive growth.

With Business Shopnaclo, users have access to customizable dashboards that display real-time data. This visibility allows for quick identification of opportunities and challenges, enabling proactive decision-making. Whether you’re tracking sales performance or monitoring customer engagement, these insights are invaluable for strategic planning.

Additionally, the analytics capabilities of Business Shopnaclo extend to predictive modeling. This feature uses historical data to forecast future trends, helping businesses anticipate market shifts and adjust their strategies accordingly. Staying ahead of the curve has never been easier with these robust analytical tools.

Maximizing Marketing Efficiency

Marketing is at the heart of any successful business, and Business Shopnaclo offers a suite of tools designed to enhance marketing efforts. From email campaigns to social media management, it provides the resources needed to reach and engage your target audience effectively.

One of the standout features is the platform’s ability to automate marketing tasks. Scheduling posts, sending newsletters, and tracking campaign performance can all be managed from one central location. This automation not only saves time but also ensures consistency in messaging and branding across all channels.

In addition to automation, Business Shopnaclo offers powerful analytics to measure the success of marketing initiatives. By analyzing engagement metrics and conversion rates, businesses can refine their strategies for maximum impact. These insights help ensure that marketing dollars are spent wisely, driving better results and higher ROI.

Enhancing Customer Relationship Management

Customers are the lifeblood of any business, and maintaining strong relationships is crucial for success. Business Shopnaclo provides comprehensive CRM tools to help businesses manage and nurture customer relationships. From lead tracking to personalized communication, it offers everything needed to build lasting connections.

One of the key benefits of using Business Shopnaclo for CRM is its ability to provide a 360-degree view of each customer. This holistic approach allows businesses to tailor their interactions based on customer preferences and history. Personalized experiences lead to increased customer satisfaction and loyalty.

Furthermore, the CRM capabilities of Business Shopnaclo include automation features to streamline customer interactions. Automated follow-ups, reminders, and task assignments ensure that no opportunity slips through the cracks. By staying organized and proactive, businesses can strengthen their relationships and drive repeat business.

Streamlining Operations for Greater Productivity

Efficiency is paramount for business success, and Business Shopnaclo offers a range of tools to streamline operations. From project management to team collaboration, it provides the resources needed to enhance productivity and achieve goals faster.

The platform’s project management features allow teams to plan, execute, and track projects from start to finish. With task assignments, timelines, and progress updates all in one place, teams can work together seamlessly, regardless of location. This transparency fosters accountability and ensures that projects stay on track.

In addition to project management, Business Shopnaclo offers communication and collaboration tools that enhance teamwork. Real-time chat, file sharing, and video conferencing enable teams to connect and collaborate effectively. These tools break down silos and promote a culture of innovation and problem-solving.

Boosting Sales with Targeted Strategies

For businesses looking to increase revenue, Business Shopnaclo offers powerful sales tools. From lead generation to closing deals, it provides the resources needed to drive sales and grow the business.

One of the standout features is the platform’s lead generation capabilities. Businesses can identify and capture leads through various channels, ensuring a steady pipeline of potential customers. Once captured, leads can be nurtured and qualified through automated workflows, increasing the likelihood of conversion.

In addition to lead generation, Business Shopnaclo offers tools to streamline the sales process. From proposal creation to contract management, it provides everything needed to close deals efficiently. By reducing administrative tasks and improving communication, sales teams can focus on what matters most—building relationships and driving results.

Building a Community of Innovation

At the heart of Business Shopnaclo is a vibrant community of like-minded business owners and entrepreneurs. This sense of community fosters collaboration, learning, and innovation, offering valuable networking opportunities for members.

Businesses can connect with peers to share insights, challenges, and successes. By learning from others’ experiences, members can gain new perspectives and ideas to apply to their own operations. This sense of camaraderie creates an environment where innovation thrives.

In addition to peer connections, Business Shopnaclo offers access to industry experts and thought leaders. Webinars, workshops, and forums provide opportunities for continued learning and professional development. By staying informed and engaged, businesses can remain competitive in an ever-evolving market.

Conclusion

In today’s digital age, staying competitive requires leveraging the right tools and strategies. Business Shopnaclo offers a comprehensive platform designed to elevate businesses to new heights, providing everything needed for success. From advanced analytics to seamless integrations, it empowers businesses to make informed decisions and drive growth.

Whether you’re a startup founder or a seasoned entrepreneur, Business Shopnaclo can help you rise and shine in your industry. By harnessing its full potential, you can streamline operations, enhance customer relationships, and boost sales. Join the community of innovators today and discover the power of Business Shopnaclo for yourself.

BUSINESS

The Secret to Thriving in Challenge House Business Centre Limited

Nestled in the heart of the bustling business district, Challenge House Business Centre Limited is more than just a workspace. It is a vibrant ecosystem where innovation meets opportunity. Whether you’re a startup founder, a freelancer, or an established business, Challenge House offers the perfect blend of facilities and community to help you thrive. In this blog post, we will explore the myriad benefits of being part of Challenge House, share insights from successful members, and provide practical tips on how to make the most of this dynamic business hub. Join us as we unravel the secrets of success at Challenge House!

The Ultimate Workspace for Entrepreneurs

Challenge House Business Centre Limited stands out as the ultimate workspace for entrepreneurs. With its state-of-the-art facilities and prime location, it offers everything a modern business needs to flourish. Entrepreneurs can enjoy access to high-speed internet, fully equipped meeting rooms, and comfortable workstations that foster productivity and creativity.

But that’s not all; Challenge House goes beyond the basics. It provides an environment that encourages collaboration and networking, connecting like-minded individuals who can inspire each other. By being part of this thriving community, entrepreneurs can find valuable partnerships and invaluable support.

The flexibility offered by Challenge House is another reason why it is the go-to choice for entrepreneurs. Whether you need a permanent office or a hot desk for the day, Challenge House caters to diverse requirements, allowing businesses to scale up or down as needed.

A Community of Innovation

At Challenge House, innovation is at the core of everything. The center is home to a diverse community of professionals from various industries, creating a melting pot of ideas and creativity. The energy within the walls of Challenge House is electric, with entrepreneurs and businesses constantly pushing boundaries and exploring new possibilities.

Regular networking events and workshops are organized, allowing members to share knowledge, collaborate on projects, and stay updated with the latest industry trends. This collaborative spirit not only enhances individual growth but also contributes to the overall success of Challenge House as a business hub.

The camaraderie among members is unparalleled. Everyone is eager to lend a hand, offer advice, or brainstorm solutions. This sense of community fosters innovation and propels businesses towards new heights.

Prime Location Advantage

Location can be a game-changer for businesses, and Challenge House Business Centre Limited offers a prime location advantage. Situated in a strategic area, it provides easy access to major transport links, making it a convenient choice for clients and employees alike.

For businesses seeking to make a strong impression, Challenge House is surrounded by an array of dining and entertainment options. This not only enhances client meetings but also provides ample opportunities for after-work socializing and team-building activities.

The proximity to other businesses and corporate headquarters is another boon. Being in the heart of the business district opens doors to potential partnerships and collaborations that can drive growth.

Flexibility and Scalability for Growing Businesses

Challenge House Business Centre Limited understands that businesses need the flexibility to adapt to changing demands. The center offers a range of office solutions, from private offices to shared spaces, allowing businesses to choose what suits them best.

This flexibility extends to lease terms as well. Businesses can opt for short-term agreements or long-term contracts, depending on their needs. This adaptability empowers businesses to focus on growth rather than worrying about space constraints.

Scalability is a key feature of Challenge House. As your business expands, you can easily upgrade to a larger space within the center, ensuring continuity and minimizing disruptions.

Hassle-Free Workspace Management

Running a business is challenging enough without having to worry about tedious administrative tasks. Challenge House takes care of all the nitty-gritty details, offering hassle-free workspace management.

From cleaning services to IT support, Challenge House ensures that businesses can concentrate on what they do best. The friendly support staff is always on hand to assist with any queries or issues, ensuring a smooth and seamless experience.

By outsourcing these operational tasks, businesses can save time and resources, allowing them to focus on growth and success. Challenge House takes care of the logistics, so you can focus on achieving your goals.

Cutting-Edge Technology and Amenities

In today’s digital age, technology is the backbone of any successful business. Challenge House Business Centre Limited is equipped with cutting-edge technology and amenities to support your business needs.

High-speed internet and advanced telecom systems ensure seamless communication and connectivity. State-of-the-art meeting rooms are equipped with the latest audiovisual equipment, making presentations and meetings a breeze.

The amenities at Challenge House are designed to enhance productivity and well-being. From cozy breakout areas to fully stocked kitchens, every detail is thoughtfully curated to ensure a comfortable and conducive working environment.

Cost-Effective Solutions for Startups

For startups, every penny counts. Challenge House Business Centre Limited offers cost-effective solutions that allow startups to access premium facilities without breaking the bank.

Shared workspaces and hot-desking options provide affordable alternatives to traditional office spaces. Startups can enjoy the benefits of a professional workspace without the hefty price tag.

Additionally, Challenge House offers bundled packages that include utilities, maintenance, and other services, simplifying the budgeting process and providing predictability in costs.

Networking and Business Opportunities

Challenge House is more than just a workspace; it’s a gateway to endless networking and business opportunities. The diverse community of businesses within the center provides a fertile ground for collaboration and growth.

Regular networking events, seminars, and workshops create opportunities for members to connect and learn from each other. The exchange of ideas and experiences often leads to partnerships and ventures that may not have been possible otherwise.

By being part of Challenge House, businesses gain access to a vast network of professionals, increasing their visibility and opening doors to new markets and opportunities.

Success Stories and Testimonials

The impact of Challenge House Business Centre Limited is best illustrated through the success stories of its members. Numerous businesses have thrived and scaled new heights from within its walls.

Testimonials from satisfied members highlight the positive experience and value that Challenge House brings to their businesses. From increased productivity to newfound partnerships, the success stories are a testament to the supportive environment.

These stories serve as inspiration for new members, showcasing the potential for growth and achievement when part of the Challenge House community.

Environmentally Conscious Facilities

Sustainability is an integral part of Challenge House’s ethos. The center is committed to minimizing its environmental footprint while providing top-notch facilities for businesses.

Eco-friendly practices, such as energy-efficient lighting and waste reduction initiatives, are implemented throughout the center. Challenge House encourages members to adopt sustainable practices, fostering a culture of responsibility and awareness.

By choosing Challenge House, businesses can align with environmentally conscious values, contributing to a greener future while enjoying the benefits of a modern workspace.

Seamless Onboarding Process

Getting started at Challenge House Business Centre Limited is a breeze. The onboarding process is seamless and efficient, allowing businesses to hit the ground running.

From the initial inquiry to setting up your workspace, the dedicated team at Challenge House guides you every step of the way. The goal is to make your transition as smooth as possible, ensuring that you feel at home from day one.

With all the essentials taken care of, you can focus on growing your business and making the most of the opportunities that Challenge House has to offer.

Conclusion

Challenge House Business Centre Limited offers much more than just office space. It is a thriving ecosystem where businesses can flourish, innovate, and grow. From its prime location to its vibrant community, Challenge House provides the perfect platform for success. Whether you’re a startup, a freelancer, or an established business, Challenge House has the resources and support to help you achieve your goals. Join the ranks of successful businesses at Challenge House and unlock your potential. Ready to take the next step? Reach out to Challenge House today and discover how they can elevate your business to new heights.

-

FOOD9 months ago

FOOD9 months agoSure! Here are seven engaging blog post titles related to the concept of a “retail food product

-

GENERAL8 months ago

GENERAL8 months agoTroubleshooting Common VRChat Login Issues: Tips and Tricks

-

INSURANCE7 months ago

INSURANCE7 months agoNavigating the Future of Insurance with Technical Reserves in Flow Insurance

-

TECH8 months ago

TECH8 months agoDiscover Reliable Abithelp Contact Solutions with JustAnswer

-

GENERAL9 months ago

GENERAL9 months agoExploring the World of Erothots: What You Need to Know

-

TECH3 months ago

TECH3 months agoWhat You Need to Know About the 346 Area Code

-

Codes3 months ago

Codes3 months agoWhat You Need to Know About the 904 Area Code

-

FOOD9 months ago

FOOD9 months agoSure! Here are seven engaging blog post titles related to a “502 food blog