INSURANCE

Navigating the Future of Insurance with Technical Reserves in Flow Insurance

In the intricate world of insurance, technical reserves are pivotal. They represent funds that insurers must set aside to cover future claims and policy benefits, ensuring financial stability and compliance with regulatory standards. For flow insurance, comprehending technical reserves is crucial.

Technical reserves are essentially the financial backbone of an insurance company. They’re not just a safety net; they ensure that companies can meet their obligations to policyholders. This financial prudence is particularly important in flow insurance, where the fluidity of cash flows and rapid settlements demand precise financial management.

For insurers, technical reserves are a testament to their financial health. They reflect an insurer’s ability to honor claims and provide peace of mind to policyholders. In flow insurance, these reserves are integral to maintaining trust and operational efficiency.

Why Flow Insurance Needs Technical Reserves

Flow insurance operates in a dynamic environment, characterized by frequent transactions and rapid settlements. In this context, technical reserves are not just a regulatory requirement but a strategic necessity. They provide a cushion against unexpected claims, ensuring that insurers can maintain liquidity and financial stability.

In the face of uncertainty, technical reserves are indispensable. They absorb shocks from high claim volumes or unforeseen events, allowing insurers to continue operations without disruptions. For flow insurance, where transactions are swift and voluminous, having robust technical reserves is a hallmark of resilience.

Furthermore, technical reserves enable insurers to make informed decisions. By analyzing reserve levels, insurers can identify trends, anticipate future liabilities, and adjust their strategies accordingly. This proactive approach is key to thriving in the competitive landscape of flow insurance.

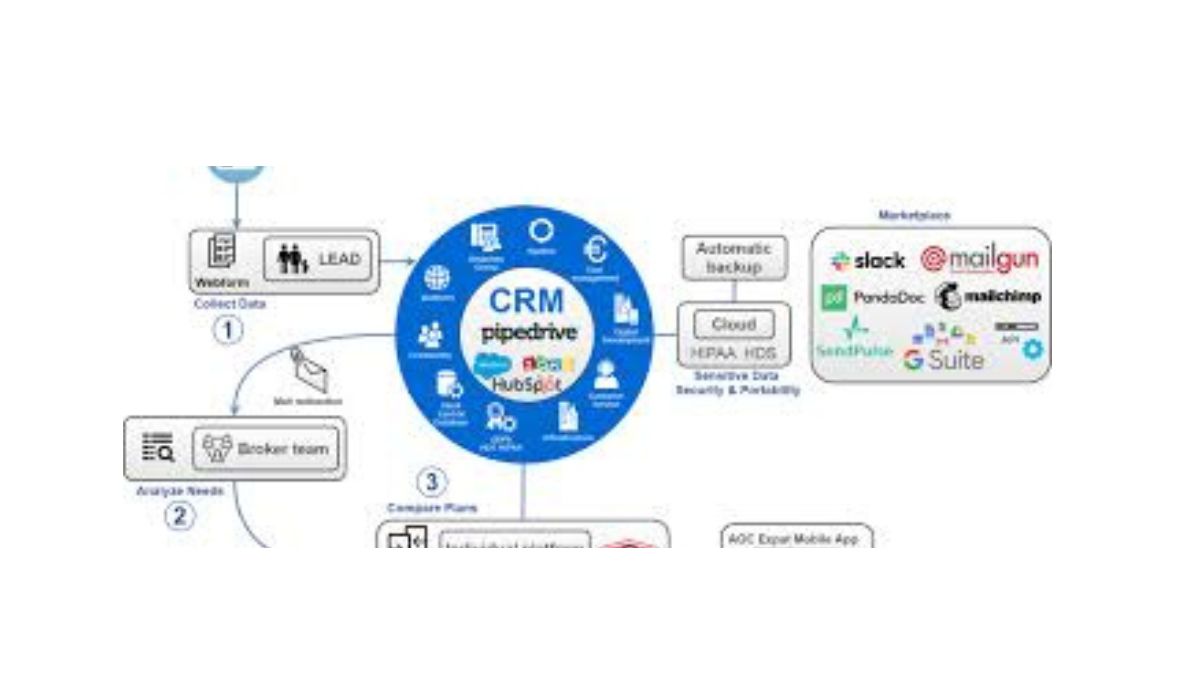

The Role of Technology in Managing Technical Reserves

Technology is revolutionizing the management of technical reserves in flow insurance. Advanced analytics, machine learning, and AI are enhancing the accuracy and efficiency of reserve calculations, enabling insurers to respond swiftly to changes in the market.

With technology, insurers can automate reserve calculations, reducing the risk of human error and ensuring compliance with regulatory standards. This automation is particularly beneficial in flow insurance, where rapid transactions demand real-time insights and quick decision-making.

Additionally, technology facilitates data-driven strategies. By leveraging data analytics, insurers can gain deeper insights into claim patterns, optimize reserve allocations, and enhance overall financial performance. This strategic use of technology is transforming how technical reserves are managed in the realm of flow insurance.

The Impact of Regulatory Changes on Technical Reserves

Regulatory changes significantly impact technical reserves in flow insurance. Insurers must stay abreast of evolving regulations to ensure compliance and maintain their financial stability. Regulatory bodies often update guidelines to enhance transparency, protect consumers, and mitigate risks.

For flow insurance, adapting to regulatory changes is essential. Insurers must be proactive in aligning their reserve management practices with new requirements. This proactive approach not only ensures compliance but also strengthens the insurer’s reputation and trustworthiness.

Regulatory changes can also present opportunities. By staying informed and agile, insurers can leverage changes to enhance their competitive edge. In flow insurance, where adaptability is key, understanding and responding to regulatory shifts is a strategic advantage.

The Importance of Actuarial Expertise in Managing Reserves

Actuarial expertise is fundamental in managing technical reserves for flow insurance. Actuaries play a crucial role in assessing risk, forecasting liabilities, and ensuring that reserves are accurately calculated and sufficient to cover future claims.

Actuaries bring a wealth of knowledge and analytical skills to reserve management. They utilize statistical models and data analysis to predict future claims and determine the appropriate level of reserves. This expertise is invaluable in flow insurance, where precision and foresight are critical.

In addition, actuaries contribute to strategic planning. By providing insights into risk trends and financial projections, they help insurers make informed decisions about reserve allocations, pricing strategies, and product development. Their expertise ensures that flow insurance companies remain resilient and financially sound.

Challenges in Maintaining Adequate Technical Reserves

Maintaining adequate technical reserves is fraught with challenges for flow insurance companies. Fluctuating claim volumes, economic uncertainties, and regulatory complexities can all impact reserve levels, requiring insurers to be vigilant and adaptable.

One of the key challenges is accurately forecasting future claims. Unpredictable events, such as natural disasters or economic downturns, can lead to sudden increases in claim volumes. Insurers must have robust risk assessment models to anticipate these fluctuations and adjust their reserves accordingly.

Another challenge is balancing reserve levels with profitability. While reserves are essential for financial stability, they also tie up capital that could be used for investment or business growth. Insurers must strike a delicate balance between maintaining adequate reserves and optimizing their financial performance.

Strategies for Optimizing Reserve Management

Optimizing reserve management is a strategic priority for flow insurance companies. By implementing effective strategies, insurers can enhance their financial resilience and competitive advantage.

One strategy is to leverage advanced analytics. By analyzing historical data and claim patterns, insurers can gain insights into future liabilities and optimize their reserve allocations accordingly. This data-driven approach enhances accuracy and efficiency in reserve management.

Another strategy is to adopt a proactive risk management approach. Insurers should regularly review and update their risk assessment models to account for emerging trends and potential threats. By staying ahead of risks, insurers can ensure their reserves remain aligned with changing market dynamics.

How Economic Factors Influence Technical Reserves

Economic factors have a profound impact on technical reserves in flow insurance. Interest rates, inflation, and economic growth all influence reserve levels and the overall financial health of insurers.

Interest rates, for example, affect the investment income generated from reserves. Low-interest rates can reduce investment returns, requiring insurers to adjust their reserve levels to maintain financial stability. Insurers must be adept at navigating these economic fluctuations to optimize their reserve management.

Inflation also plays a role in reserve management. Rising costs of claims and administrative expenses can erode reserve levels, impacting an insurer’s ability to meet future liabilities. Insurers must factor in inflationary trends when calculating their reserves to ensure adequacy and sustainability.

The Future of Technical Reserves in Flow Insurance

The future of technical reserves in flow insurance is shaped by technological advancements, regulatory changes, and evolving market dynamics. Insurers must be agile and forward-thinking to thrive in this rapidly changing landscape.

Emerging technologies, such as blockchain and AI, are poised to revolutionize reserve management. These technologies offer enhanced transparency, accuracy, and efficiency, enabling insurers to optimize their reserves and improve overall performance.

Additionally, regulatory changes will continue to influence reserve management practices. Insurers must stay informed and adaptable to ensure compliance and leverage regulatory shifts to their advantage. By proactively responding to these changes, insurers can strengthen their position in the competitive flow insurance market.

Building a Culture of Resilience and Innovation in Reserve Management

Building a culture of resilience and innovation is essential for effective reserve management in flow insurance. Insurers must foster a mindset of continuous improvement and adaptability to thrive in a dynamic environment.

Encouraging innovation in reserve management practices can lead to enhanced efficiency and accuracy. Insurers should invest in technology and data analytics to optimize their reserve management processes and gain a competitive edge.

Furthermore, fostering a culture of resilience involves proactive risk management and strategic planning. Insurers must regularly review and update their reserve management strategies to account for emerging trends and potential threats. By staying ahead of risks, insurers can ensure their reserves remain aligned with changing market dynamics.

Conclusion

In conclusion, technical reserves are a foundational element of flow insurance, ensuring financial stability and regulatory compliance. By understanding and optimizing reserve management practices, insurers can enhance their resilience and competitive advantage.

Through the strategic use of technology, actuarial expertise, and proactive risk management, insurers can optimize their reserves and thrive in the dynamic flow insurance market. As the landscape continues to evolve, insurers must remain agile and forward-thinking to secure their position and drive success in the industry.

For those looking to deepen their understanding of technical reserves and their role in flow insurance, further resources and expert guidance are available. By staying informed and leveraging best practices, insurers can build a strong foundation for future growth and success.

INSURANCE

Bader Insurance Company Demystified Discover How They Protect What Matters Most

In today’s unpredictable world, having the right insurance coverage can make all the difference. Whether it’s protecting your home, car, or business, knowing you’re backed by a reliable insurance provider offers peace of mind. Enter Bader Insurance Company, a name synonymous with trust and comprehensive coverage. This blog is dedicated to unraveling what makes Bader Insurance stand out in the crowded insurance landscape and how their offerings can cater to you.

Insurance isn’t just about policy documents and premiums—it’s about safeguarding the people and things you hold dear. Bader Insurance understands this deeply, crafting solutions that are as personalized as they are protective. Throughout this post, we’ll explore the various types of insurance coverage Bader offers, their customer-centric approach, and how they consistently adapt to the changing needs of their clients.

Bader Insurance Company An Overview

Bader Insurance Company has been a stalwart in the industry for decades, providing a wide array of insurance products. Their reputation is built on a foundation of trust, reliability, and customer satisfaction. But what truly sets them apart from the rest?

At the heart of Bader’s operations is a commitment to transparency and excellence. They believe in empowering clients through education, ensuring that every policyholder fully understands their coverage. This approach not only builds confidence but also ensures that customers can make informed decisions about their insurance needs.

Beyond the policies, Bader Insurance is deeply invested in building lasting relationships. Their team of dedicated professionals works tirelessly to provide exceptional service, whether it’s assisting with a claim or helping choose the right coverage. This dedication is why they have maintained a loyal client base over the years.

Tailored Coverage for Individuals

When it comes to personal insurance, Bader offers a comprehensive suite of options tailored to fit your unique lifestyle. From auto to home insurance, they cover a spectrum of personal needs to ensure you’re protected against life’s uncertainties.

Auto insurance is a critical need for most individuals, and Bader excels in providing coverage that meets specific requirements. They offer various plans, from basic liability to comprehensive coverage, all designed to protect you and your vehicle. Their auto insurance policies also come with added benefits like roadside assistance and rental reimbursement, ensuring you’re never left stranded.

Homeowners insurance is another vital offering by Bader. Recognizing that your home is more than just a structure—it’s your sanctuary—their policies provide thorough protection against common perils. Whether it’s damage from natural disasters or theft, Bader’s homeowner’s insurance ensures that your home and belongings are safeguarded.

Comprehensive Business Solutions

Businesses face a myriad of risks in today’s marketplace, and having the right insurance is essential to mitigate potential losses. Bader Insurance provides robust solutions designed to protect your business assets and operations.

Understanding that every business is unique, Bader offers tailored commercial insurance policies. These policies are crafted after a thorough risk assessment, ensuring that all potential threats are covered. From liability and property insurance to workers’ compensation, Bader’s comprehensive offerings cater to businesses of all sizes.

Additionally, Bader’s business insurance solutions include specialized coverage options. Whether you’re running a retail store, manufacturing plant, or service-based company, they have the expertise to provide insurance that aligns with your industry-specific needs. This nuanced approach helps businesses stay resilient, even in the face of unexpected challenges.

The Importance of Customer Service

One of the most critical aspects of any insurance company is its customer service, and Bader Insurance shines brightly in this area. Their commitment to serving clients with empathy and efficiency is unmatched, making them a preferred choice for many.

At Bader, customer service goes beyond answering queries—it’s about being there when it matters most. Their team is available to assist with any concerns, ensuring that clients feel supported throughout their insurance journey. Whether it’s understanding policy terms or filing a claim, Bader’s customer service team provides clear guidance every step of the way.

The feedback from clients is a testament to Bader’s dedication to customer satisfaction. Many highlight the seamless claim process and the attentive nature of the service team, emphasizing how Bader’s approach turns stressful situations into manageable ones. This level of service fosters trust and strengthens the bond between the company and its clients.

Technological Advancements in Insurance

In a rapidly evolving digital landscape, Bader Insurance Company is at the forefront of integrating technology into their operations. Their commitment to leveraging tech advancements ensures that clients receive efficient and effective service.

Bader’s digital platform offers clients the ability to manage policies online, view statements, and even file claims with ease. This user-friendly interface is designed to simplify the insurance experience, allowing clients to access important information anytime, anywhere. The convenience of managing insurance digitally saves time and enhances the overall customer experience.

Furthermore, Bader is exploring new technological frontiers, such as AI-powered analytics and blockchain, to further enhance their offerings. By staying ahead of technological trends, Bader Insurance aims to provide innovative solutions that meet the evolving needs of their clientele while maintaining the highest standards of security and privacy.

Community Engagement and Social Responsibility

Bader Insurance Company believes in giving back to the communities they serve. Their commitment to social responsibility extends beyond providing excellent insurance services to actively participating in community development initiatives.

Bader engages in various charitable activities and partnerships with local organizations. From sponsoring community events to supporting educational programs, their contributions have a positive impact on society. This dedication to social responsibility not only strengthens community ties but also enriches the lives of those they support.

Their culture of giving is deeply ingrained within the organization, encouraging employees to participate in volunteering and other philanthropic efforts. This holistic approach to social responsibility reflects Bader’s values and reinforces their standing as a company that genuinely cares about its community.

Bader’s Commitment to Sustainable Practices

In addition to their community engagement, Bader Insurance is committed to sustainability and environmentally friendly practices. Understanding the significance of reducing their carbon footprint, Bader implements green initiatives across their operations.

Efforts include reducing paper usage by encouraging digital communication and investing in energy-efficient office spaces. Bader is also exploring partnerships with eco-friendly organizations to further promote sustainability within the insurance industry. By adopting these practices, Bader Insurance aims to contribute to a healthier planet while setting an example for others to follow.

Their sustainability efforts resonate with clients who value environmental consciousness, creating a positive impact both within and outside the organization. This approach to sustainable practices positions Bader Insurance as a forward-thinking company that prioritizes the well-being of the planet for future generations.

How Bader Insurance Adapts to Market Changes

The insurance industry is constantly evolving, influenced by economic shifts, regulatory changes, and emerging risks. Bader Insurance Company demonstrates exceptional adaptability, ensuring they remain competitive and relevant in the market.

By closely monitoring industry trends and conducting regular market analyses, Bader stays informed of any changes that may affect their clients. This proactive stance allows them to adjust their offerings and strategies to continue meeting client needs effectively. Bader’s ability to adapt to market dynamics reinforces their reputation as a reliable insurance provider.

Collaboration with industry experts and continuous employee training further enhances Bader’s adaptability. By fostering a culture of learning and innovation, Bader ensures that their team is well-equipped to address new challenges and seize opportunities for growth.

Navigating Claims with Ease

An essential aspect of any insurance service is the claims process. Bader Insurance Company prioritizes making this process as straightforward and stress-free as possible for their clients.

Bader’s claims process is designed with transparency and efficiency in mind. Clients are guided through each step, ensuring they understand the requirements and timelines involved. This clarity helps to eliminate confusion and anxiety, allowing clients to focus on resolving their issues.

Additionally, Bader provides dedicated claims representatives who offer personalized assistance. These experts are available to answer questions, provide updates, and advocate on behalf of clients, ensuring that claims are processed promptly and fairly. This high level of support contributes to Bader’s reputation for excellence in customer service.

Exploring Bader’s Exclusive Benefits

Choosing Bader Insurance Company comes with several exclusive benefits that set them apart from other providers. These advantages enhance the client experience and provide additional value beyond standard coverage.

One notable benefit is Bader’s loyalty rewards program, which offers discounts and incentives to long-term clients. This program not only acknowledges client commitment but also provides tangible savings on premiums and services.

Bader also offers unique policy features, such as customizable coverage options and flexible payment plans. These features allow clients to tailor their insurance to fit their specific needs and budget, providing greater control over their financial commitments.

Preparing for Your Future with Bader

Insurance is not just about protecting your present—it’s about securing your future. Bader Insurance Company is dedicated to helping clients plan for a prosperous and worry-free future.

Through personalized consultations and expert guidance, Bader assists clients in assessing their long-term insurance needs. This forward-thinking approach ensures that clients are well-prepared for any eventuality, providing peace of mind and financial stability.

Bader’s commitment to future-readiness extends to offering educational resources and workshops. These initiatives empower clients with the knowledge and tools necessary to make informed decisions about their insurance and financial planning.

Conclusion

Bader Insurance Company stands out as a leader in the insurance industry, offering comprehensive coverage, exceptional customer service, and innovative solutions tailored to meet client needs. By focusing on sustainability, community engagement, and technological advancements, Bader demonstrates a commitment to excellence that resonates with clients and sets them apart from the competition.

For those seeking reliable insurance solutions that prioritize both present protection and future planning, Bader Insurance Company is a trusted partner. Explore their offerings and discover how they can help you secure what matters most in your life.

INSURANCE

Navigating the World of Insurance with BB Insure Limited’s Expertise

In today’s unpredictable world, insurance isn’t just a luxury—it’s a necessity. Whether you’re protecting your home, health, or business, having the right coverage can make all the difference. This is where BB Insure Limited steps in. With their comprehensive range of services, BB Insure not only simplifies the complex world of insurance but also offers personalized plans tailored to your unique needs. In this blog post, we’ll explore how BB Insure Limited is revolutionizing the way people protect what matters most.

Understanding the Basics of Insurance with BB Insure

At its core, insurance is about risk management. By paying a premium, you transfer the financial risk of unexpected events to an insurance company. BB Insure Limited excels in providing this peace of mind through a variety of insurance products. Whether you’re new to insurance or looking to expand your existing coverage, BB Insure has options to fit every lifestyle and budget.

BB Insure Limited offers a user-friendly approach to insurance, breaking down complex terms and policies into easy-to-understand language. This ensures that clients fully grasp the coverage they are purchasing. Their team of experts is always ready to answer questions and provide guidance, making the insurance-buying process smooth and stress-free.

Another standout feature of BB Insure is their commitment to keeping clients informed. Regular updates and insights are shared to help clients stay ahead of changes in the insurance industry. This proactive approach empowers clients to make informed decisions about their insurance needs.

The Comprehensive Coverage Offered by BB Insure Limited

BB Insure Limited prides itself on offering a wide range of insurance products. From auto and home insurance to health and business coverage, they have you covered. Each policy is designed to offer maximum protection at competitive rates, ensuring you get the best value for your money.

One of the key offerings of BB Insures is their customizable insurance plans. Recognizing that no two clients are the same, they provide flexible options that can be tailored to meet specific needs. Whether you’re a first-time homeowner or a small business owner, BB Insure Limited has a policy that suits your requirements.

In addition to providing standard coverage, BB Insures Limited also offers specialized insurance products. These include personal liability insurance, travel insurance, and cyber insurance. By staying ahead of emerging risks, BB Insure ensures their clients are protected against a wide array of potential threats.

Why Choose BB Insure Limited Over Competitors?

Choosing an insurance provider is a significant decision, and BB Insure Limited stands out for several reasons. First and foremost, they prioritize customer satisfaction. With a dedicated team that goes above and beyond to meet client needs, BB Insures ensures a seamless and positive experience.

Another reason to choose BB Insure is their reputation for reliability and trustworthiness. With years of experience in the industry, they have established themselves as a leading insurance provider. Their commitment to integrity and transparency has earned them the trust of countless clients.

Finally, BB Insures Limited is constantly innovating. They leverage the latest technology to streamline processes and enhance the customer experience. From online policy management to 24/7 customer support, BB Insures uses digital tools to provide efficient and effective service.

The Role of BB Insure Limited in Business Protection

For business owners, having the right insurance is crucial to safeguarding their operations. BB Insure Limited offers a range of business insurance products designed to protect against a variety of risks. From property damage to liability claims, their coverage ensures businesses can continue to operate without disruption.

BB Insures Limited takes the time to understand each client’s business and tailor coverage accordingly. This personalized approach ensures comprehensive protection that addresses the unique challenges faced by different industries. Their expert advisors work closely with clients to identify potential risks and develop strategies to mitigate them.

In addition to standard business insurance, BB Insures offers specialized products such as professional liability and workers’ compensation insurance. These options provide additional layers of protection for businesses, helping them manage specific risks more effectively.

Protecting Your Home and Personal Assets with BB Insure

Home is where the heart is, and BB Insure Limited understands the importance of protecting it. Their home insurance policies offer extensive coverage against damage, theft, and other unforeseen events. With BB Insure, homeowners can rest easy knowing their investments are safeguarded.

BB Insures Limited also provides valuable resources to help homeowners prevent damage before it occurs. From maintenance tips to emergency preparedness guides, they empower clients to take proactive steps in protecting their homes. This comprehensive approach ensures clients are well-equipped to handle any situation.

Furthermore, BB Insure offers additional coverage options for personal assets. Whether it’s jewelry, electronics, or other valuables, their policies can be customized to include protection for these items. This ensures that clients’ cherished possessions are covered under any circumstances.

Health and Wellness Coverage from BB Insure Limited

Your health is your most valuable asset, and BB Insure Limited offers a range of health insurance options to keep you and your loved ones protected. Their policies cover everything from routine check-ups to major medical expenses, ensuring comprehensive care for all stages of life.

BB Insures Limited works with a network of healthcare providers to offer clients access to quality medical services. Their health plans are designed to be flexible and affordable, with options to fit different budgets and needs. Whether you’re looking for individual coverage or family plans, BB Insures has you covered.

In addition to standard health insurance, BB Insures provides wellness programs and resources to promote healthy living. From fitness tips to dietary advice, they offer valuable insights to help clients lead healthier lifestyles. This holistic approach to health coverage sets BB Insures apart from other providers.

How BB Insure Limited Supports Community Engagement

BB Insure Limited is more than just an insurance provider; they are a committed community partner. Through various initiatives and partnerships, they actively contribute to the well-being of the communities they serve. Their efforts range from sponsoring local events to supporting charitable causes.

BB Insures Limited encourages clients to get involved in community efforts as well. By fostering a sense of connection and collaboration, they aim to create a positive impact beyond the realm of insurance. This commitment to community engagement reflects their core values and enhances their reputation as a socially responsible company.

Through their community involvement, BB Insures Limited also gains valuable insights into the needs and concerns of their clients. This feedback helps them refine their products and services, ensuring they continue to meet the evolving needs of their clientele.

The Future of Insurance with BB Insure Limited

Looking ahead, BB Insure Limited is poised to continue leading the insurance industry with innovation and excellence. They are committed to staying ahead of trends and adapting to changing market conditions, ensuring clients receive the best possible service and coverage.

BB Insures Limited is also exploring new technologies to enhance their offerings. From AI-driven analytics to mobile app development, they are leveraging cutting-edge tools to provide even greater value to clients. These advancements will further streamline processes and improve the overall customer experience.

By maintaining their focus on customer satisfaction and industry leadership, BB Insure Limited is well-positioned for future success. Their dedication to innovation and integrity ensures they will remain a trusted partner for clients seeking reliable insurance solutions.

Conclusion

In conclusion, BB Insure Limited is a powerhouse in the insurance industry, offering comprehensive coverage, expert guidance, and a commitment to customer satisfaction. Their wide range of products and services cater to diverse needs, ensuring clients receive the protection they deserve. Whether you’re safeguarding your home, health, or business, BB Insures is the partner you can trust on your insurance journey.

To learn more about how BB Insures Limited can help protect what matters most to you, visit their website or speak with one of their knowledgeable advisors today. Don’t wait for the unexpected—secure your future with BB Insures.

INSURANCE

Discover Peace of Mind with AXC Insurance Your Ultimate Coverage Companion

In a world full of uncertainties, having the right insurance coverage can provide the peace of mind you need to live your life confidently. Whether it’s protecting your home, car, health, or business, understanding the nuances of insurance policies can be quite the challenge. Enter AXC Insurance—your ultimate guide to navigating the complex world of coverage. In this blog post, we’ll explore how AXC Insurance stands out from the competition, offering a variety of plans tailored to meet your unique needs. From comprehensive car insurance to bespoke business coverage, we’ve got you covered.

Why Choose AXC Insurance

When selecting an insurance provider, you want a company that not only understands your needs but also offers reliable service and competitive rates. AXC Insurance ticks all these boxes. With a long-standing reputation in the industry, AXC is committed to providing its clients with top-notch services and a wide array of coverage options. By focusing on customer satisfaction and innovative solutions, AXC Insurance ensures you get the most value for your money.

AXC Insurance distinguishes itself through its customer-centric approach. The company prides itself on being accessible and approachable, making it easy for clients to get the assistance they need. Their dedicated team of professionals is always ready to offer personalized advice and support, ensuring you have the right coverage for your situation. When you choose AXC Insurance, you’re not just a policyholder—you’re part of a family.

Furthermore, AXC Insurance’s commitment to transparency and honesty makes it a trusted choice for many individuals and businesses. They take the time to explain the intricacies of each policy, ensuring you fully understand your coverage and any potential limitations. With AXC Insurance, there are no hidden surprises—only straightforward, reliable service.

Comprehensive Coverage Options

One of the key advantages of AXC Insurance is the diverse range of coverage options available. From personal insurance to commercial policies, AXC has something to suit every need. This comprehensive selection allows clients to customize their coverage, ensuring they are well-protected in all aspects of their lives. Let’s explore some of the popular coverage options offered by AXC Insurance.

For individuals, AXC provides a variety of personal insurance plans, including auto, home, health, and life insurance. These plans are designed to offer maximum protection and peace of mind, giving you the confidence to face life’s uncertainties. With AXC’s flexible policies, you can tailor your coverage to fit your lifestyle and budget.

Businesses can also benefit from AXC’s extensive range of commercial insurance offerings. From general liability and property insurance to specialized coverage for specific industries, AXC Insurance helps protect your business against potential risks. This allows you to focus on what you do best—growing your business—while AXC takes care of the rest.

In addition to these standard insurance options, AXC also offers supplementary coverage to enhance your existing policies. This includes umbrella insurance, which provides added protection for liability claims, and identity theft coverage, which safeguards your personal information from cybercriminals. By offering these additional options, AXC Insurance ensures you have a comprehensive safety net in place.

Tailored Solutions for Every Client

At AXC Insurance, we understand that no two clients are the same. That’s why we offer tailored insurance solutions to meet the unique needs of each individual or business. By working closely with our clients, we identify their specific requirements and develop customized coverage plans that provide optimal protection and value.

Our personalized approach begins with a thorough assessment of your current situation and future needs. This allows us to recommend the most suitable insurance products and identify any gaps in your coverage. With AXC Insurance, you can be confident that your policy is designed to address your unique circumstances and potential risks.

Additionally, our team of experienced professionals is always available to provide ongoing support and advice. Whether you need to update your policy, file a claim, or simply have a question about your coverage, we’re here to help. Our commitment to exceptional customer service ensures you receive the assistance you need when you need it most.

AXC Insurance also offers regular policy reviews to ensure your coverage remains relevant as your needs change over time. By keeping your insurance up-to-date, we help you stay protected against new risks and opportunities. This proactive approach allows you to adapt your coverage to your evolving circumstances, ensuring you always have the right protection in place.

AXC Insurance for Your Vehicle

When it comes to protecting your vehicle, AXC Insurance offers a variety of auto insurance options designed to provide comprehensive coverage and peace of mind. Whether you own a car, motorcycle, or recreational vehicle, AXC has a policy tailored to your specific needs. Let’s take a closer look at what AXC auto insurance has to offer.

One of the standout features of AXC auto insurance is its customizable coverage options. Clients can choose from a range of standard coverage types, including liability, collision, and comprehensive insurance. By tailoring your policy to your unique requirements, you can ensure you have the right level of protection for your vehicle and your budget.

AXC Insurance also offers a range of optional coverage enhancements to further protect your vehicle and your assets. This includes uninsured/underinsured motorist coverage, which safeguards you against drivers without adequate insurance, and roadside assistance, which provides help in case of a breakdown or emergency. These additional options allow you to customize your policy to meet your specific needs and preferences.

Furthermore, AXC Insurances is committed to providing competitive rates and discounts to help you save on your auto insurance premiums. By offering incentives for safe driving, bundling policies, and maintaining a clean driving record, AXC makes it easy for clients to access affordable coverage without sacrificing quality.

Protecting Your Home with AXC Insurance

Your home is one of your most valuable assets, and protecting it should be a top priority. AXC Insurance offers a range of home insurance options designed to safeguard your property and belongings from potential risks. With AXC’s comprehensive coverage, you can enjoy peace of mind knowing your home is well-protected.

AXC home insurance policies cover a wide array of potential perils, including fire, theft, vandalism, and natural disasters. By offering flexible coverage options, AXC ensures you have the protection you need to keep your home safe and secure. This comprehensive approach allows you to focus on enjoying your home, rather than worrying about potential risks.

In addition to standard coverage, AXC Insurances also provides optional enhancements to further protect your home and assets. This includes coverage for valuable personal items, such as jewelry and electronics, as well as liability protection for accidents that occur on your property. By customizing your policy, you can ensure your home and belongings are adequately protected against unforeseen events.

AXC Insurance is also committed to helping clients save on their home insurance premiums. By offering discounts for bundling policies, installing security systems, and maintaining a claims-free history, AXC makes it easy for you to access affordable coverage without sacrificing quality. With AXC Insurance, protecting your home has never been more accessible or cost-effective.

Health and Life Insurance Options

In today’s uncertain world, having the right health and life insurance coverage is essential for protecting yourself and your loved ones. AXC Insurance offers a variety of health and life insurance options designed to provide comprehensive protection and peace of mind. Let’s explore what AXC has to offer in this crucial area.

AXC health insurance plans are designed to provide comprehensive coverage for a wide range of medical expenses, including doctor visits, hospital stays, and prescription medications. By offering flexible policy options, AXC ensures you have the protection you need to maintain your health and well-being. With AXC health insurance, you can access quality care without breaking the bank.

In addition to health insurance, AXC also offers a range of life insurance options designed to provide financial security for your loved ones in the event of your passing. From term life insurance to whole life policies, AXC has a plan tailored to your specific needs and budget. By providing comprehensive coverage, AXC ensures your family is well-protected and financially secure.

AXC Insurance is committed to making insurance coverage accessible and affordable for all clients. By offering competitive rates and discounts for healthy lifestyles, AXC helps you save on your health and life insurance premiums. With AXC’s comprehensive coverage and cost-effective options, protecting yourself and your loved ones has never been easier.

Business Insurance for Every Industry

Running a business can be a rewarding yet challenging endeavor. To protect your hard work and investment, it’s essential to have the right insurance coverage in place. AXC Insurance offers a wide range of business insurance options tailored to suit the unique needs of various industries. Let’s take a closer look at what AXC has to offer for business owners.

AXC business insurance policies cover a wide array of potential risks, including general liability, property damage, and workers’ compensation. By offering flexible coverage options, AXC ensures you have the protection you need to safeguard your business assets and operations. This comprehensive approach allows you to focus on growing your business, rather than worrying about potential liabilities.

In addition to standard coverage, AXC Insurance also provides specialized policies for specific industries, such as construction, retail, and hospitality. By tailoring your coverage to your industry’s unique needs, AXC helps you address potential risks and challenges more effectively. This personalized approach ensures your business is well-protected, regardless of the industry you operate in.

AXC Insurances is also committed to helping business owners save on their premiums. By offering discounts for bundling policies, maintaining a safe work environment, and implementing risk management practices, AXC makes it easy for you to access affordable coverage without sacrificing quality. With AXC Insurance, protecting your business has never been more accessible or cost-effective.

The AXC Insurance Claims Process

Navigating the claims process can be a daunting experience, but AXC Insurance is committed to making it as smooth and hassle-free as possible. By providing efficient and transparent claims handling, AXC ensures you receive the support and compensation you need when you need it most. Let’s explore how the AXC Insurance claims process works.

The first step in filing a claim with AXC Insurances is to contact their claims department. Their friendly and knowledgeable team is available to guide you through the process and answer any questions you may have. By providing clear instructions and guidance, AXC ensures you understand every aspect of your claim and what to expect moving forward.

Once your claim is filed, AXC Insurance will assign a dedicated claims adjuster to assess your situation and determine the appropriate course of action. By working closely with you, the adjuster will gather all necessary information and documentation to ensure a fair and accurate settlement. This personalized approach ensures your claim is handled efficiently and effectively.

AXC Insurances is committed to keeping clients informed throughout the claims process. By providing regular updates and clear communication, AXC ensures you remain informed and involved every step of the way. With their transparent and efficient claims handling, AXC Insurances offers the support and peace of mind you need during challenging times.

AXC Insurance’s Commitment to Sustainability

At AXC Insurance, we believe that a sustainable future is essential for everyone. That’s why we are committed to incorporating environmentally friendly practices into our operations and supporting initiatives that promote sustainability. Let’s explore how AXC Insurances is making a positive impact on the environment and our communities.

One of the ways AXC Insurance demonstrates its commitment to sustainability is through its eco-friendly business practices. By implementing energy-efficient technologies and reducing paper usage, AXC is working to minimize its environmental footprint. This commitment to sustainability extends to our clients by offering paperless billing and electronic communications, reducing waste, and promoting a greener future.

In addition to our internal efforts, AXC Insurance is proud to support various environmental initiatives and organizations that promote sustainability. By partnering with these groups, AXC helps raise awareness and drive positive change in our communities. This commitment to environmental stewardship reflects our dedication to creating a better world for future generations.

AXC Insurances also encourages clients to adopt sustainable practices by offering discounts and incentives for eco-friendly choices. By promoting green building practices, energy-efficient vehicles, and other environmentally responsible actions, AXC supports clients in their efforts to create a more sustainable future. Together, we can make a significant impact on the environment and create lasting change.

The Benefits of Choosing AXC Insurance

When it comes to selecting an insurance provider, AXC Insurance offers numerous benefits that set it apart from the competition. With a strong focus on customer satisfaction, innovative solutions, and comprehensive coverage options, AXC is the ideal choice for individuals and businesses seeking reliable protection and peace of mind.

One of the primary benefits of choosing AXC Insurances is its commitment to customer service. By providing personalized support and expert advice, AXC ensures clients receive the assistance they need when they need it most. This customer-centric approach fosters trust and confidence, making AXC a preferred choice for many policyholders.

Additionally, AXC Insurances offers a wide range of coverage options tailored to meet the unique needs of each client. By providing flexible policies and customizable coverage, AXC ensures you have the protection you need to safeguard your assets and loved ones. This comprehensive approach allows you to focus on what matters most—living your life with confidence.

Finally, AXC Insurance is dedicated to offering competitive rates and discounts to help clients save on their premiums. By providing cost-effective options without sacrificing quality, AXC makes it easy for you to access affordable insurance coverage. With AXC Insurances, you can enjoy the peace of mind that comes with knowing you have reliable protection in place.

How to Get Started with AXC Insurance

If you’re ready to experience the benefits of AXC Insurance for yourself, getting started is easy. With a streamlined process and dedicated support, AXC makes it simple for you to find the coverage you need and begin enjoying the peace of mind you deserve. Let’s explore the steps to getting started with AXC Insurances.

The first step in starting your AXC Insurances journey is to contact their friendly and knowledgeable team. By discussing your specific needs and requirements, AXC can recommend the most suitable coverage options for your situation. This personalized approach ensures you receive the protection you need to safeguard your assets and loved ones.

Once you’ve identified the right coverage, AXC Insurance will guide you through the application process. By providing clear instructions and support, AXC ensures a smooth and stress-free experience. With their efficient and transparent process, you can be confident you’re making the right choice for your insurance needs.

Finally, once your policy is in place, AXC Insurances offers ongoing support and resources to help you make the most of your coverage. From regular policy reviews to expert advice, AXC is committed to ensuring you have the protection you need throughout your life. With AXC Insurance, you can enjoy peace of mind knowing you have reliable support by your side.

Conclusion

In today’s uncertain world, having the right insurance coverage is essential for protecting your assets and loved ones. With AXC Insurances, you can enjoy the peace of mind that comes with knowing you have reliable protection in place. By offering comprehensive coverage options, personalized support, and competitive rates, AXC Insurances is the ideal choice for individuals and businesses seeking reliable insurance solutions.

If you’re ready to experience the benefits of AXC Insurance for yourself, don’t hesitate to get in touch with their dedicated team of professionals. By working closely with you to understand your unique needs, AXC ensures you receive the protection you need to safeguard your future. With AXC Insurances by your side, you can face life’s uncertainties with confidence and peace of mind.

For more information on AXC Insurance and how they can help you protect your assets and loved ones, visit their website or contact their team today. With their commitment to customer satisfaction and innovative solutions, AXC Insurances is your ultimate guide to comprehensive insurance coverage.

-

FOOD10 months ago

FOOD10 months agoSure! Here are seven engaging blog post titles related to the concept of a “retail food product

-

GENERAL10 months ago

GENERAL10 months agoTroubleshooting Common VRChat Login Issues: Tips and Tricks

-

TECH9 months ago

TECH9 months agoDiscover Reliable Abithelp Contact Solutions with JustAnswer

-

FOOD10 months ago

FOOD10 months agoSure! Here are seven engaging blog post titles related to a “502 food blog

-

GENERAL11 months ago

GENERAL11 months agoExploring the World of Erothots: What You Need to Know

-

HEALTH10 months ago

HEALTH10 months agoMaine Health Jobs: A Comprehensive Guide

-

TECH5 months ago

TECH5 months agoWhat You Need to Know About the 346 Area Code

-

Codes5 months ago

Codes5 months agoWhat You Need to Know About the 904 Area Code