INSURANCE

Navigating the Digital Maze of Home Insurance Purchases

In today’s digital age, buying home insurance online is easier and more accessible than ever. However, with countless options at your fingertips, it can also be overwhelming. This comprehensive guide is designed to help you confidently purchase home insurance online. We’ll walk you through the essential steps, provide practical tips, and highlight common pitfalls. By the end, you’ll be equipped to make an informed decision that protects your home and gives you peace of mind.

Understanding the Importance of Home Insurance

Home is where the heart is, but it’s also where many of life’s unexpected events can occur. Home insurance provides a safety net against potential damages and losses. From natural disasters to theft, a reliable policy can save you from significant financial burdens. Understanding the importance of home insurance is crucial for safeguarding your property and assets.

A comprehensive home insurance policy covers structural damage, personal belongings, and liability protection. This means that not only is your house itself protected, but so are your possessions like furniture, electronics, and clothing. Additionally, if someone gets injured on your property, liability coverage can protect you from costly lawsuits. By investing in home insurance, you’re not just protecting your physical property but also securing your financial future.

Having home insurance also contributes to long-term peace of mind. Knowing that you’re covered allows you to focus on enjoying your home rather than worrying about what could go wrong. This sense of security is invaluable and underscores the importance of selecting the right policy for your needs.

The Rise of Online Insurance Platforms

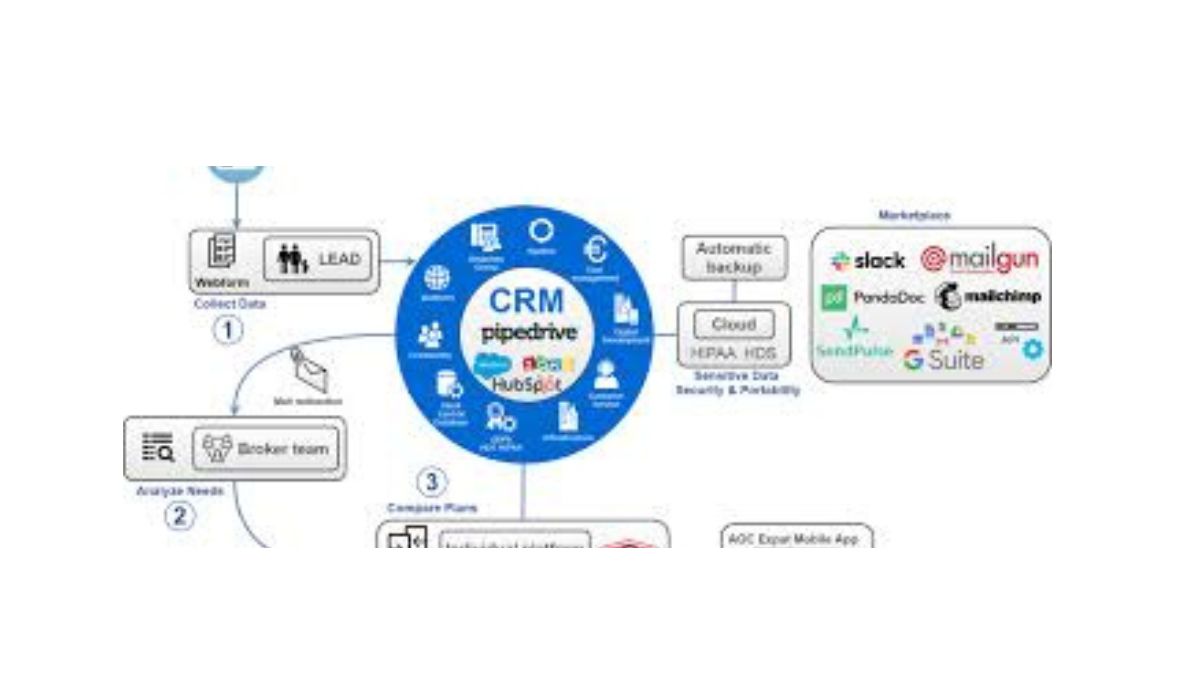

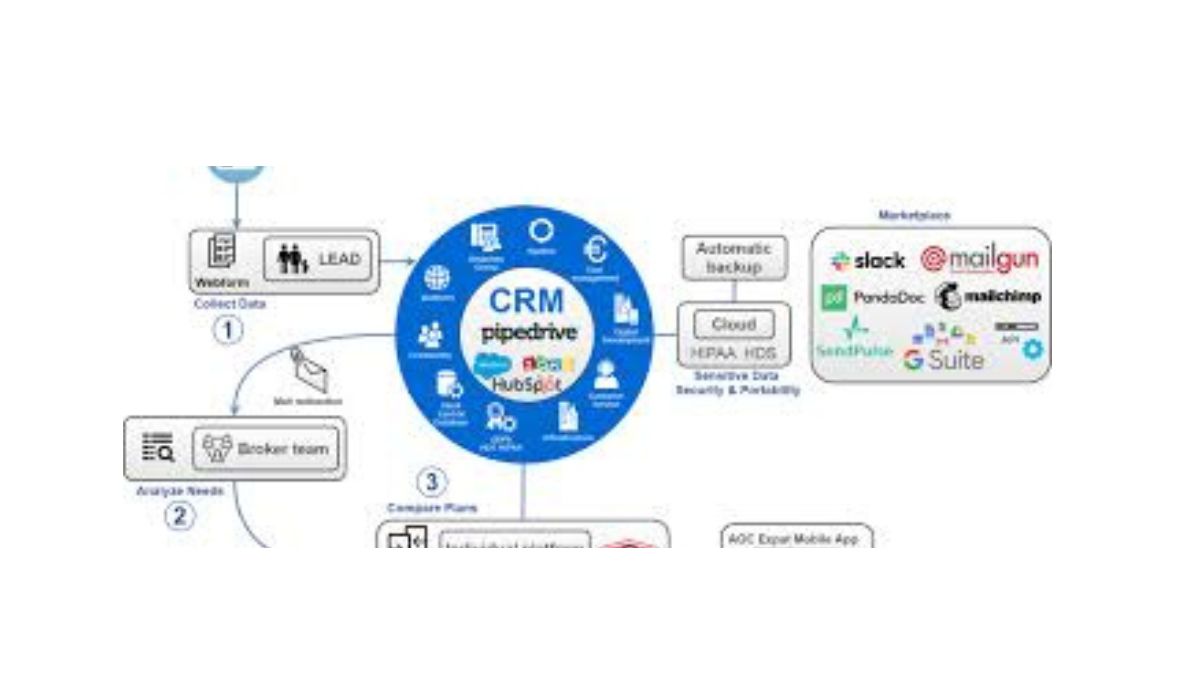

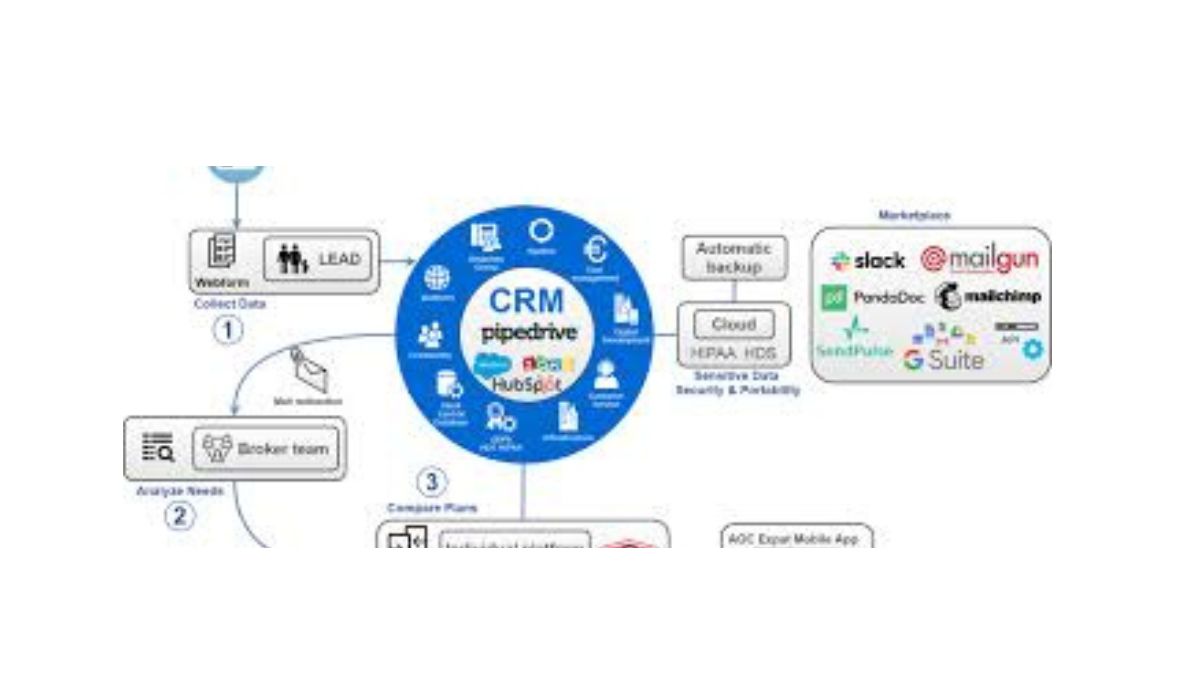

With the advent of technology, purchasing insurance has transformed from a tedious task into a streamlined digital process. Online insurance platforms have made it easier for consumers to compare rates, customize plans, and make informed decisions from the comfort of their homes.

These platforms offer several advantages over traditional methods. They provide immediate access to a wealth of information, including detailed policy options and customer reviews. This transparency empowers consumers to make more informed choices tailored to their unique needs. Additionally, many platforms offer tools that allow you to calculate potential premiums and coverage options based on your specific circumstances.

The convenience of online platforms means you can shop for home insurance at any time, without the pressure of in-person sales tactics. This flexibility enables you to take the time you need to research and understand your options fully. It’s a game-changer for busy homeowners who want to ensure they’re making the best decision for their home and family.

Preparing to Buy Home Insurance Online

Before jumping into the world of online home insurance, it’s important to do a little homework. Preparation can make all the difference in finding a policy that suits your specific needs and budget.

Start by assessing your home’s value and the belongings within it. Understanding the worth of your property will help you determine the level of coverage you need. Make a list of your possessions, especially high-value items, as this will influence your insurance requirements.

Next, research the risks associated with your location. Factors such as proximity to natural disaster-prone areas or high-crime regions can affect your insurance needs and costs. Being aware of these risks ensures that you choose a policy that offers adequate protection.

Lastly, gather any necessary documents, such as previous insurance records or mortgage details. Having these at hand will expedite the application process and ensure you have all the information you need to make an informed choice.

Evaluating Your Coverage Needs

Understanding your specific coverage needs is a crucial step in buying home insurance online. Every homeowner’s situation is different, and the right policy for one person might not be suitable for another.

Begin by considering the structure of your home. Coverage should be sufficient to rebuild your home in case of a total loss. This requires an understanding of the current construction costs in your area, as well as any unique features your home might have.

Next, evaluate the value of your personal possessions. This includes everything from electronics to clothing. Many people underestimate the value of their belongings, so it’s important to take a thorough inventory to ensure you select an appropriate level of coverage.

Finally, think about liability coverage. This protects you in the event someone is injured on your property. The amount of liability coverage needed can vary depending on factors like the size of your home, whether you have a pool, or if you frequently host guests. Comprehensive coverage will provide peace of mind that you’re protected in various scenarios.

Comparing Different Insurance Providers

With numerous insurance providers online, it’s essential to compare your options to find the best fit for your needs. Not all policies are created equal, so take the time to explore what’s available.

Start by researching different companies and reading customer reviews. This will give you insight into the experiences of other policyholders and the level of service each provider offers. Look for consistent patterns in feedback, both positive and negative, to gauge reliability.

When comparing providers, pay attention to the specifics of their policies. Some may offer additional features or benefits that others don’t, such as discounts for bundling multiple types of insurance or incentives for installing home security systems. These extras can add significant value to your policy.

Finally, consider the financial stability of the insurance company. Providers with strong financial ratings are more likely to remain stable and capable of fulfilling claims, ensuring that your investment remains secure over time.

Customizing Your Home Insurance Policy

One of the benefits of buying home insurance online is the ability to customize your policy to suit your needs. This flexibility allows you to tailor coverage options to better protect your home and belongings.

Customization can begin with selecting different levels of coverage for various aspects of your policy. You might opt for basic coverage for certain items while choosing enhanced protection for high-value belongings. This approach ensures you’re not paying for unnecessary coverage while still securing what’s most important.

Additionally, many online platforms allow you to add endorsements or riders to your policy. These are provisions that modify the standard policy to cover specific items or events, such as jewelry, art collections, or natural disasters. Tailoring your policy in this way ensures it aligns closely with your lifestyle and risk profile.

Before finalizing your policy, consider the deductibles associated with your coverage. A higher deductible often results in lower premiums, but it’s essential to choose an amount you can comfortably afford in the event of a claim. Balancing deductibles with premium costs can further optimize your policy’s value.

Assessing the Cost of Home Insurance

Cost is a significant factor when purchasing home insurance. Understanding what influences premium rates can help you make informed decisions and potentially save money.

Several factors affect the cost of home insurance, including the age and condition of your home, its location, and the materials used in its construction. Homes in areas prone to natural disasters or with higher crime rates may result in higher premiums. Similarly, older homes might incur higher costs due to increased repair expenses.

Your personal circumstances also play a role. For instance, having a good credit score can lead to lower premiums, as it’s often seen as an indicator of responsible financial behavior. Additionally, the coverage limits and deductibles you choose directly impact the overall cost of your policy.

To manage costs, consider bundling home insurance with other types of coverage, such as auto or life insurance. Many providers offer discounts for multiple policies, resulting in significant savings. Regularly reviewing your policy and comparing it with others can also ensure you’re getting the best possible rate.

Checking Policy Exclusions and Limits

When buying home insurance online, it’s crucial to understand the policy’s exclusions and limits. These are the aspects of coverage that are either not included or have specific conditions attached.

Exclusions refer to situations or events that your policy does not cover. Common exclusions might include damage caused by floods, earthquakes, or acts of war. Understanding these limitations ensures that you’re not caught off guard in a situation where you assumed you were covered.

Limits, on the other hand, refer to the maximum amount the insurance company will pay for a particular claim. It’s important to know these limits to ensure they align with the value of your home and belongings. If they fall short, you might need to consider additional coverage or policy endorsements.

By carefully reviewing exclusions and limits, you can make adjustments to your policy or seek additional protection if necessary. This proactive approach ensures you’re fully covered in the ways that matter most to you.

Utilizing Online Tools and Resources

Online platforms offer a wealth of tools and resources to assist in your home insurance purchase. Leveraging these can lead to a more informed and efficient buying process.

Comparison websites allow you to view multiple providers and policies side-by-side, highlighting differences in coverage and cost. This transparency helps you make a more informed decision about which policy offers the best value for your needs.

Many insurance websites also feature calculators that estimate the cost of premiums based on your specific inputs, such as location, home value, and desired coverage. These tools provide a clearer picture of what to expect financially and allow you to adjust variables to see how they impact costs.

In addition to these tools, educational resources can enhance your understanding of home insurance. Articles, guides, and FAQs on insurance websites often address common questions and concerns, helping demystify the process for first-time buyers.

Completing the Online Purchase Process

Once you’ve researched and selected the right policy, completing the online purchase process is the next step. Most platforms streamline this process, making it quick and straightforward.

Begin by confirming your chosen policy and coverage details. Ensure that all the information provided is accurate, as discrepancies can affect your coverage or claim eligibility later on. Double-check the specifics, including coverage limits, deductibles, and endorsements.

Next, review the payment options available. Many providers offer flexible payment plans, allowing you to choose between monthly, quarterly, or annual payments. Selecting a plan that aligns with your budget can make managing your policy more convenient.

Finally, after completing the payment, print or save a copy of your policy documents. Having these on hand ensures you can quickly access them when needed, whether for review or during a claim process. With your policy in place, you can enjoy peace of mind knowing your home is protected.

Staying Engaged with Your Insurance Provider

After purchasing home insurance online, staying engaged with your provider is essential for maintaining optimal coverage. Regular communication ensures that your policy continues to meet your changing needs.

Periodically review your policy, especially after major life events like home renovations, acquiring valuable items, or changes in family size. These milestones may require adjustments to your coverage levels or endorsements.

Additionally, keep an eye on any communications from your provider, such as newsletters or policy updates. These often contain important information about changes to your policy, new discounts, or additional services that could benefit you.

Engaging with your provider also means taking advantage of the resources they offer. Many companies provide customer support through multiple channels, including phone, email, and chat. If you have questions or need guidance, don’t hesitate to reach out for assistance.

Taking the First Step Towards Smart Home Insurance

In conclusion, buying home insurance online offers convenience, flexibility, and the ability to tailor policies to your specific needs. By understanding your coverage requirements, comparing options, and utilizing available tools, you can confidently choose a policy that protects your home and belongings.

Remember, home insurance is not just a financial product; it’s a critical investment in your peace of mind. With the right policy in place, you’re free to enjoy your home, knowing you’re prepared for life’s unexpected events.

Keeping Track of Your Policy and Claims

As part of managing your home insurance effectively, it is important to keep track of your policy details and any claims you might file. Maintain an organized record of your policy documents, including the coverage specifics, contact information for your insurer, and any amendments made to your policy over time. Additionally, regularly updating your home inventory can greatly benefit any claims process; having a detailed list of your belongings exists to provide proof of ownership and value in case of loss.

When filing a claim, document all related events, such as photographs of damages, receipts, and communication with your insurer. This organized approach can simplify the claims process and ensure that you receive the compensation you are entitled to. Remember that timely reporting of claims is crucial, as most policies require that claims be filed within a specific time frame to be considered valid. By staying proactive and keeping detailed records, you can navigate potential claims more smoothly and maintain peace of mind knowing you’re well-prepared.

Ready to start your home insurance journey? Take the first step today by exploring online platforms and comparing policies to find the perfect fit for your unique situation. Your future self will thank you.

Understanding Policy Exclusions and Limitations

It’s crucial to familiarize yourself with the exclusions and limitations of your home insurance policy to avoid surprises when making a claim. Most policies outline specific instances or types of damage that are not covered, such as maintenance-related issues, natural disasters, or certain types of personal property. Understanding these exclusions helps you make informed decisions about additional coverage options or endorsements that may be necessary to protect your home and belongings fully.

For instance, standard homeowners’ insurance often does not cover flooding, requiring a separate flood insurance policy if you live in a flood-prone area. Similarly, valuable personal items like jewelry or art may exceed standard policy limits, necessitating additional coverage. Reviewing your policy thoroughly and discussing any concerns with your insurance provider can ensure that you are adequately protected against potential risks. Being proactive in understanding these aspects can lead to better preparedness and peace of mind in the long run.

Regularly Revisiting Your Insurance Needs

As your life changes, so do your insurance needs. Regularly revisiting your home insurance policy ensures it remains aligned with your current situation and provides adequate coverage. It’s advisable to assess your home and belongings periodically, especially after significant life events such as moving, renovations, or acquiring high-value items.

By conducting these reviews, you can determine if your current policy effectively addresses your needs or if adjustments are necessary. This ongoing evaluation fosters a sense of security, knowing you have the right protection in place. Tracking changes in the value of your home, understanding new risks, or keeping up with policy trends can all contribute to a more effective insurance strategy. Ultimately, staying attuned to your insurance needs is a critical step in safeguarding your home and ensuring financial security.

The Importance of Emergency Preparedness

In addition to maintaining adequate home insurance coverage, being prepared for emergencies is essential to safeguard your home and family. Developing an emergency plan can significantly reduce the impact of unforeseen events like natural disasters, fires, or other crises. Start by assessing potential risks specific to your area, such as hurricanes, earthquakes, or floods, and formulate a tailored response plan.

Ensure that all family members are familiar with emergency procedures, including evacuation routes and meeting points. It’s also wise to assemble an emergency kit containing essentials such as food, water, first aid supplies, and important documents. Regularly reviewing and practicing your emergency plan can help reinforce readiness and ensure that everyone knows what to do when the unexpected occurs. By integrating emergency preparedness with your insurance strategy, you enhance your overall safety and resilience, allowing for greater peace of mind in your home environment.

INSURANCE

Navigating the Future of Insurance with Technical Reserves in Flow Insurance

In the intricate world of insurance, technical reserves are pivotal. They represent funds that insurers must set aside to cover future claims and policy benefits, ensuring financial stability and compliance with regulatory standards. For flow insurance, comprehending technical reserves is crucial.

Technical reserves are essentially the financial backbone of an insurance company. They’re not just a safety net; they ensure that companies can meet their obligations to policyholders. This financial prudence is particularly important in flow insurance, where the fluidity of cash flows and rapid settlements demand precise financial management.

For insurers, technical reserves are a testament to their financial health. They reflect an insurer’s ability to honor claims and provide peace of mind to policyholders. In flow insurance, these reserves are integral to maintaining trust and operational efficiency.

Why Flow Insurance Needs Technical Reserves

Flow insurance operates in a dynamic environment, characterized by frequent transactions and rapid settlements. In this context, technical reserves are not just a regulatory requirement but a strategic necessity. They provide a cushion against unexpected claims, ensuring that insurers can maintain liquidity and financial stability.

In the face of uncertainty, technical reserves are indispensable. They absorb shocks from high claim volumes or unforeseen events, allowing insurers to continue operations without disruptions. For flow insurance, where transactions are swift and voluminous, having robust technical reserves is a hallmark of resilience.

Furthermore, technical reserves enable insurers to make informed decisions. By analyzing reserve levels, insurers can identify trends, anticipate future liabilities, and adjust their strategies accordingly. This proactive approach is key to thriving in the competitive landscape of flow insurance.

The Role of Technology in Managing Technical Reserves

Technology is revolutionizing the management of technical reserves in flow insurance. Advanced analytics, machine learning, and AI are enhancing the accuracy and efficiency of reserve calculations, enabling insurers to respond swiftly to changes in the market.

With technology, insurers can automate reserve calculations, reducing the risk of human error and ensuring compliance with regulatory standards. This automation is particularly beneficial in flow insurance, where rapid transactions demand real-time insights and quick decision-making.

Additionally, technology facilitates data-driven strategies. By leveraging data analytics, insurers can gain deeper insights into claim patterns, optimize reserve allocations, and enhance overall financial performance. This strategic use of technology is transforming how technical reserves are managed in the realm of flow insurance.

The Impact of Regulatory Changes on Technical Reserves

Regulatory changes significantly impact technical reserves in flow insurance. Insurers must stay abreast of evolving regulations to ensure compliance and maintain their financial stability. Regulatory bodies often update guidelines to enhance transparency, protect consumers, and mitigate risks.

For flow insurance, adapting to regulatory changes is essential. Insurers must be proactive in aligning their reserve management practices with new requirements. This proactive approach not only ensures compliance but also strengthens the insurer’s reputation and trustworthiness.

Regulatory changes can also present opportunities. By staying informed and agile, insurers can leverage changes to enhance their competitive edge. In flow insurance, where adaptability is key, understanding and responding to regulatory shifts is a strategic advantage.

The Importance of Actuarial Expertise in Managing Reserves

Actuarial expertise is fundamental in managing technical reserves for flow insurance. Actuaries play a crucial role in assessing risk, forecasting liabilities, and ensuring that reserves are accurately calculated and sufficient to cover future claims.

Actuaries bring a wealth of knowledge and analytical skills to reserve management. They utilize statistical models and data analysis to predict future claims and determine the appropriate level of reserves. This expertise is invaluable in flow insurance, where precision and foresight are critical.

In addition, actuaries contribute to strategic planning. By providing insights into risk trends and financial projections, they help insurers make informed decisions about reserve allocations, pricing strategies, and product development. Their expertise ensures that flow insurance companies remain resilient and financially sound.

Challenges in Maintaining Adequate Technical Reserves

Maintaining adequate technical reserves is fraught with challenges for flow insurance companies. Fluctuating claim volumes, economic uncertainties, and regulatory complexities can all impact reserve levels, requiring insurers to be vigilant and adaptable.

One of the key challenges is accurately forecasting future claims. Unpredictable events, such as natural disasters or economic downturns, can lead to sudden increases in claim volumes. Insurers must have robust risk assessment models to anticipate these fluctuations and adjust their reserves accordingly.

Another challenge is balancing reserve levels with profitability. While reserves are essential for financial stability, they also tie up capital that could be used for investment or business growth. Insurers must strike a delicate balance between maintaining adequate reserves and optimizing their financial performance.

Strategies for Optimizing Reserve Management

Optimizing reserve management is a strategic priority for flow insurance companies. By implementing effective strategies, insurers can enhance their financial resilience and competitive advantage.

One strategy is to leverage advanced analytics. By analyzing historical data and claim patterns, insurers can gain insights into future liabilities and optimize their reserve allocations accordingly. This data-driven approach enhances accuracy and efficiency in reserve management.

Another strategy is to adopt a proactive risk management approach. Insurers should regularly review and update their risk assessment models to account for emerging trends and potential threats. By staying ahead of risks, insurers can ensure their reserves remain aligned with changing market dynamics.

How Economic Factors Influence Technical Reserves

Economic factors have a profound impact on technical reserves in flow insurance. Interest rates, inflation, and economic growth all influence reserve levels and the overall financial health of insurers.

Interest rates, for example, affect the investment income generated from reserves. Low-interest rates can reduce investment returns, requiring insurers to adjust their reserve levels to maintain financial stability. Insurers must be adept at navigating these economic fluctuations to optimize their reserve management.

Inflation also plays a role in reserve management. Rising costs of claims and administrative expenses can erode reserve levels, impacting an insurer’s ability to meet future liabilities. Insurers must factor in inflationary trends when calculating their reserves to ensure adequacy and sustainability.

The Future of Technical Reserves in Flow Insurance

The future of technical reserves in flow insurance is shaped by technological advancements, regulatory changes, and evolving market dynamics. Insurers must be agile and forward-thinking to thrive in this rapidly changing landscape.

Emerging technologies, such as blockchain and AI, are poised to revolutionize reserve management. These technologies offer enhanced transparency, accuracy, and efficiency, enabling insurers to optimize their reserves and improve overall performance.

Additionally, regulatory changes will continue to influence reserve management practices. Insurers must stay informed and adaptable to ensure compliance and leverage regulatory shifts to their advantage. By proactively responding to these changes, insurers can strengthen their position in the competitive flow insurance market.

Building a Culture of Resilience and Innovation in Reserve Management

Building a culture of resilience and innovation is essential for effective reserve management in flow insurance. Insurers must foster a mindset of continuous improvement and adaptability to thrive in a dynamic environment.

Encouraging innovation in reserve management practices can lead to enhanced efficiency and accuracy. Insurers should invest in technology and data analytics to optimize their reserve management processes and gain a competitive edge.

Furthermore, fostering a culture of resilience involves proactive risk management and strategic planning. Insurers must regularly review and update their reserve management strategies to account for emerging trends and potential threats. By staying ahead of risks, insurers can ensure their reserves remain aligned with changing market dynamics.

Conclusion

In conclusion, technical reserves are a foundational element of flow insurance, ensuring financial stability and regulatory compliance. By understanding and optimizing reserve management practices, insurers can enhance their resilience and competitive advantage.

Through the strategic use of technology, actuarial expertise, and proactive risk management, insurers can optimize their reserves and thrive in the dynamic flow insurance market. As the landscape continues to evolve, insurers must remain agile and forward-thinking to secure their position and drive success in the industry.

For those looking to deepen their understanding of technical reserves and their role in flow insurance, further resources and expert guidance are available. By staying informed and leveraging best practices, insurers can build a strong foundation for future growth and success.

INSURANCE

Bader Insurance Company Demystified Discover How They Protect What Matters Most

In today’s unpredictable world, having the right insurance coverage can make all the difference. Whether it’s protecting your home, car, or business, knowing you’re backed by a reliable insurance provider offers peace of mind. Enter Bader Insurance Company, a name synonymous with trust and comprehensive coverage. This blog is dedicated to unraveling what makes Bader Insurance stand out in the crowded insurance landscape and how their offerings can cater to you.

Insurance isn’t just about policy documents and premiums—it’s about safeguarding the people and things you hold dear. Bader Insurance understands this deeply, crafting solutions that are as personalized as they are protective. Throughout this post, we’ll explore the various types of insurance coverage Bader offers, their customer-centric approach, and how they consistently adapt to the changing needs of their clients.

Bader Insurance Company An Overview

Bader Insurance Company has been a stalwart in the industry for decades, providing a wide array of insurance products. Their reputation is built on a foundation of trust, reliability, and customer satisfaction. But what truly sets them apart from the rest?

At the heart of Bader’s operations is a commitment to transparency and excellence. They believe in empowering clients through education, ensuring that every policyholder fully understands their coverage. This approach not only builds confidence but also ensures that customers can make informed decisions about their insurance needs.

Beyond the policies, Bader Insurance is deeply invested in building lasting relationships. Their team of dedicated professionals works tirelessly to provide exceptional service, whether it’s assisting with a claim or helping choose the right coverage. This dedication is why they have maintained a loyal client base over the years.

Tailored Coverage for Individuals

When it comes to personal insurance, Bader offers a comprehensive suite of options tailored to fit your unique lifestyle. From auto to home insurance, they cover a spectrum of personal needs to ensure you’re protected against life’s uncertainties.

Auto insurance is a critical need for most individuals, and Bader excels in providing coverage that meets specific requirements. They offer various plans, from basic liability to comprehensive coverage, all designed to protect you and your vehicle. Their auto insurance policies also come with added benefits like roadside assistance and rental reimbursement, ensuring you’re never left stranded.

Homeowners insurance is another vital offering by Bader. Recognizing that your home is more than just a structure—it’s your sanctuary—their policies provide thorough protection against common perils. Whether it’s damage from natural disasters or theft, Bader’s homeowner’s insurance ensures that your home and belongings are safeguarded.

Comprehensive Business Solutions

Businesses face a myriad of risks in today’s marketplace, and having the right insurance is essential to mitigate potential losses. Bader Insurance provides robust solutions designed to protect your business assets and operations.

Understanding that every business is unique, Bader offers tailored commercial insurance policies. These policies are crafted after a thorough risk assessment, ensuring that all potential threats are covered. From liability and property insurance to workers’ compensation, Bader’s comprehensive offerings cater to businesses of all sizes.

Additionally, Bader’s business insurance solutions include specialized coverage options. Whether you’re running a retail store, manufacturing plant, or service-based company, they have the expertise to provide insurance that aligns with your industry-specific needs. This nuanced approach helps businesses stay resilient, even in the face of unexpected challenges.

The Importance of Customer Service

One of the most critical aspects of any insurance company is its customer service, and Bader Insurance shines brightly in this area. Their commitment to serving clients with empathy and efficiency is unmatched, making them a preferred choice for many.

At Bader, customer service goes beyond answering queries—it’s about being there when it matters most. Their team is available to assist with any concerns, ensuring that clients feel supported throughout their insurance journey. Whether it’s understanding policy terms or filing a claim, Bader’s customer service team provides clear guidance every step of the way.

The feedback from clients is a testament to Bader’s dedication to customer satisfaction. Many highlight the seamless claim process and the attentive nature of the service team, emphasizing how Bader’s approach turns stressful situations into manageable ones. This level of service fosters trust and strengthens the bond between the company and its clients.

Technological Advancements in Insurance

In a rapidly evolving digital landscape, Bader Insurance Company is at the forefront of integrating technology into their operations. Their commitment to leveraging tech advancements ensures that clients receive efficient and effective service.

Bader’s digital platform offers clients the ability to manage policies online, view statements, and even file claims with ease. This user-friendly interface is designed to simplify the insurance experience, allowing clients to access important information anytime, anywhere. The convenience of managing insurance digitally saves time and enhances the overall customer experience.

Furthermore, Bader is exploring new technological frontiers, such as AI-powered analytics and blockchain, to further enhance their offerings. By staying ahead of technological trends, Bader Insurance aims to provide innovative solutions that meet the evolving needs of their clientele while maintaining the highest standards of security and privacy.

Community Engagement and Social Responsibility

Bader Insurance Company believes in giving back to the communities they serve. Their commitment to social responsibility extends beyond providing excellent insurance services to actively participating in community development initiatives.

Bader engages in various charitable activities and partnerships with local organizations. From sponsoring community events to supporting educational programs, their contributions have a positive impact on society. This dedication to social responsibility not only strengthens community ties but also enriches the lives of those they support.

Their culture of giving is deeply ingrained within the organization, encouraging employees to participate in volunteering and other philanthropic efforts. This holistic approach to social responsibility reflects Bader’s values and reinforces their standing as a company that genuinely cares about its community.

Bader’s Commitment to Sustainable Practices

In addition to their community engagement, Bader Insurance is committed to sustainability and environmentally friendly practices. Understanding the significance of reducing their carbon footprint, Bader implements green initiatives across their operations.

Efforts include reducing paper usage by encouraging digital communication and investing in energy-efficient office spaces. Bader is also exploring partnerships with eco-friendly organizations to further promote sustainability within the insurance industry. By adopting these practices, Bader Insurance aims to contribute to a healthier planet while setting an example for others to follow.

Their sustainability efforts resonate with clients who value environmental consciousness, creating a positive impact both within and outside the organization. This approach to sustainable practices positions Bader Insurance as a forward-thinking company that prioritizes the well-being of the planet for future generations.

How Bader Insurance Adapts to Market Changes

The insurance industry is constantly evolving, influenced by economic shifts, regulatory changes, and emerging risks. Bader Insurance Company demonstrates exceptional adaptability, ensuring they remain competitive and relevant in the market.

By closely monitoring industry trends and conducting regular market analyses, Bader stays informed of any changes that may affect their clients. This proactive stance allows them to adjust their offerings and strategies to continue meeting client needs effectively. Bader’s ability to adapt to market dynamics reinforces their reputation as a reliable insurance provider.

Collaboration with industry experts and continuous employee training further enhances Bader’s adaptability. By fostering a culture of learning and innovation, Bader ensures that their team is well-equipped to address new challenges and seize opportunities for growth.

Navigating Claims with Ease

An essential aspect of any insurance service is the claims process. Bader Insurance Company prioritizes making this process as straightforward and stress-free as possible for their clients.

Bader’s claims process is designed with transparency and efficiency in mind. Clients are guided through each step, ensuring they understand the requirements and timelines involved. This clarity helps to eliminate confusion and anxiety, allowing clients to focus on resolving their issues.

Additionally, Bader provides dedicated claims representatives who offer personalized assistance. These experts are available to answer questions, provide updates, and advocate on behalf of clients, ensuring that claims are processed promptly and fairly. This high level of support contributes to Bader’s reputation for excellence in customer service.

Exploring Bader’s Exclusive Benefits

Choosing Bader Insurance Company comes with several exclusive benefits that set them apart from other providers. These advantages enhance the client experience and provide additional value beyond standard coverage.

One notable benefit is Bader’s loyalty rewards program, which offers discounts and incentives to long-term clients. This program not only acknowledges client commitment but also provides tangible savings on premiums and services.

Bader also offers unique policy features, such as customizable coverage options and flexible payment plans. These features allow clients to tailor their insurance to fit their specific needs and budget, providing greater control over their financial commitments.

Preparing for Your Future with Bader

Insurance is not just about protecting your present—it’s about securing your future. Bader Insurance Company is dedicated to helping clients plan for a prosperous and worry-free future.

Through personalized consultations and expert guidance, Bader assists clients in assessing their long-term insurance needs. This forward-thinking approach ensures that clients are well-prepared for any eventuality, providing peace of mind and financial stability.

Bader’s commitment to future-readiness extends to offering educational resources and workshops. These initiatives empower clients with the knowledge and tools necessary to make informed decisions about their insurance and financial planning.

Conclusion

Bader Insurance Company stands out as a leader in the insurance industry, offering comprehensive coverage, exceptional customer service, and innovative solutions tailored to meet client needs. By focusing on sustainability, community engagement, and technological advancements, Bader demonstrates a commitment to excellence that resonates with clients and sets them apart from the competition.

For those seeking reliable insurance solutions that prioritize both present protection and future planning, Bader Insurance Company is a trusted partner. Explore their offerings and discover how they can help you secure what matters most in your life.

INSURANCE

Navigating the World of Insurance with BB Insure Limited’s Expertise

In today’s unpredictable world, insurance isn’t just a luxury—it’s a necessity. Whether you’re protecting your home, health, or business, having the right coverage can make all the difference. This is where BB Insure Limited steps in. With their comprehensive range of services, BB Insure not only simplifies the complex world of insurance but also offers personalized plans tailored to your unique needs. In this blog post, we’ll explore how BB Insure Limited is revolutionizing the way people protect what matters most.

Understanding the Basics of Insurance with BB Insure

At its core, insurance is about risk management. By paying a premium, you transfer the financial risk of unexpected events to an insurance company. BB Insure Limited excels in providing this peace of mind through a variety of insurance products. Whether you’re new to insurance or looking to expand your existing coverage, BB Insure has options to fit every lifestyle and budget.

BB Insure Limited offers a user-friendly approach to insurance, breaking down complex terms and policies into easy-to-understand language. This ensures that clients fully grasp the coverage they are purchasing. Their team of experts is always ready to answer questions and provide guidance, making the insurance-buying process smooth and stress-free.

Another standout feature of BB Insure is their commitment to keeping clients informed. Regular updates and insights are shared to help clients stay ahead of changes in the insurance industry. This proactive approach empowers clients to make informed decisions about their insurance needs.

The Comprehensive Coverage Offered by BB Insure Limited

BB Insure Limited prides itself on offering a wide range of insurance products. From auto and home insurance to health and business coverage, they have you covered. Each policy is designed to offer maximum protection at competitive rates, ensuring you get the best value for your money.

One of the key offerings of BB Insures is their customizable insurance plans. Recognizing that no two clients are the same, they provide flexible options that can be tailored to meet specific needs. Whether you’re a first-time homeowner or a small business owner, BB Insure Limited has a policy that suits your requirements.

In addition to providing standard coverage, BB Insures Limited also offers specialized insurance products. These include personal liability insurance, travel insurance, and cyber insurance. By staying ahead of emerging risks, BB Insure ensures their clients are protected against a wide array of potential threats.

Why Choose BB Insure Limited Over Competitors?

Choosing an insurance provider is a significant decision, and BB Insure Limited stands out for several reasons. First and foremost, they prioritize customer satisfaction. With a dedicated team that goes above and beyond to meet client needs, BB Insures ensures a seamless and positive experience.

Another reason to choose BB Insure is their reputation for reliability and trustworthiness. With years of experience in the industry, they have established themselves as a leading insurance provider. Their commitment to integrity and transparency has earned them the trust of countless clients.

Finally, BB Insures Limited is constantly innovating. They leverage the latest technology to streamline processes and enhance the customer experience. From online policy management to 24/7 customer support, BB Insures uses digital tools to provide efficient and effective service.

The Role of BB Insure Limited in Business Protection

For business owners, having the right insurance is crucial to safeguarding their operations. BB Insure Limited offers a range of business insurance products designed to protect against a variety of risks. From property damage to liability claims, their coverage ensures businesses can continue to operate without disruption.

BB Insures Limited takes the time to understand each client’s business and tailor coverage accordingly. This personalized approach ensures comprehensive protection that addresses the unique challenges faced by different industries. Their expert advisors work closely with clients to identify potential risks and develop strategies to mitigate them.

In addition to standard business insurance, BB Insures offers specialized products such as professional liability and workers’ compensation insurance. These options provide additional layers of protection for businesses, helping them manage specific risks more effectively.

Protecting Your Home and Personal Assets with BB Insure

Home is where the heart is, and BB Insure Limited understands the importance of protecting it. Their home insurance policies offer extensive coverage against damage, theft, and other unforeseen events. With BB Insure, homeowners can rest easy knowing their investments are safeguarded.

BB Insures Limited also provides valuable resources to help homeowners prevent damage before it occurs. From maintenance tips to emergency preparedness guides, they empower clients to take proactive steps in protecting their homes. This comprehensive approach ensures clients are well-equipped to handle any situation.

Furthermore, BB Insure offers additional coverage options for personal assets. Whether it’s jewelry, electronics, or other valuables, their policies can be customized to include protection for these items. This ensures that clients’ cherished possessions are covered under any circumstances.

Health and Wellness Coverage from BB Insure Limited

Your health is your most valuable asset, and BB Insure Limited offers a range of health insurance options to keep you and your loved ones protected. Their policies cover everything from routine check-ups to major medical expenses, ensuring comprehensive care for all stages of life.

BB Insures Limited works with a network of healthcare providers to offer clients access to quality medical services. Their health plans are designed to be flexible and affordable, with options to fit different budgets and needs. Whether you’re looking for individual coverage or family plans, BB Insures has you covered.

In addition to standard health insurance, BB Insures provides wellness programs and resources to promote healthy living. From fitness tips to dietary advice, they offer valuable insights to help clients lead healthier lifestyles. This holistic approach to health coverage sets BB Insures apart from other providers.

How BB Insure Limited Supports Community Engagement

BB Insure Limited is more than just an insurance provider; they are a committed community partner. Through various initiatives and partnerships, they actively contribute to the well-being of the communities they serve. Their efforts range from sponsoring local events to supporting charitable causes.

BB Insures Limited encourages clients to get involved in community efforts as well. By fostering a sense of connection and collaboration, they aim to create a positive impact beyond the realm of insurance. This commitment to community engagement reflects their core values and enhances their reputation as a socially responsible company.

Through their community involvement, BB Insures Limited also gains valuable insights into the needs and concerns of their clients. This feedback helps them refine their products and services, ensuring they continue to meet the evolving needs of their clientele.

The Future of Insurance with BB Insure Limited

Looking ahead, BB Insure Limited is poised to continue leading the insurance industry with innovation and excellence. They are committed to staying ahead of trends and adapting to changing market conditions, ensuring clients receive the best possible service and coverage.

BB Insures Limited is also exploring new technologies to enhance their offerings. From AI-driven analytics to mobile app development, they are leveraging cutting-edge tools to provide even greater value to clients. These advancements will further streamline processes and improve the overall customer experience.

By maintaining their focus on customer satisfaction and industry leadership, BB Insure Limited is well-positioned for future success. Their dedication to innovation and integrity ensures they will remain a trusted partner for clients seeking reliable insurance solutions.

Conclusion

In conclusion, BB Insure Limited is a powerhouse in the insurance industry, offering comprehensive coverage, expert guidance, and a commitment to customer satisfaction. Their wide range of products and services cater to diverse needs, ensuring clients receive the protection they deserve. Whether you’re safeguarding your home, health, or business, BB Insures is the partner you can trust on your insurance journey.

To learn more about how BB Insures Limited can help protect what matters most to you, visit their website or speak with one of their knowledgeable advisors today. Don’t wait for the unexpected—secure your future with BB Insures.

-

FOOD10 months ago

FOOD10 months agoSure! Here are seven engaging blog post titles related to the concept of a “retail food product

-

GENERAL9 months ago

GENERAL9 months agoTroubleshooting Common VRChat Login Issues: Tips and Tricks

-

INSURANCE9 months ago

INSURANCE9 months agoNavigating the Future of Insurance with Technical Reserves in Flow Insurance

-

TECH9 months ago

TECH9 months agoDiscover Reliable Abithelp Contact Solutions with JustAnswer

-

FOOD10 months ago

FOOD10 months agoSure! Here are seven engaging blog post titles related to a “502 food blog

-

GENERAL11 months ago

GENERAL11 months agoExploring the World of Erothots: What You Need to Know

-

HEALTH10 months ago

HEALTH10 months agoMaine Health Jobs: A Comprehensive Guide

-

Codes5 months ago

Codes5 months agoWhat You Need to Know About the 904 Area Code