GENERAL

Unlocking the Secrets of Spyi Ex-Dividend Date: What You Need to Know

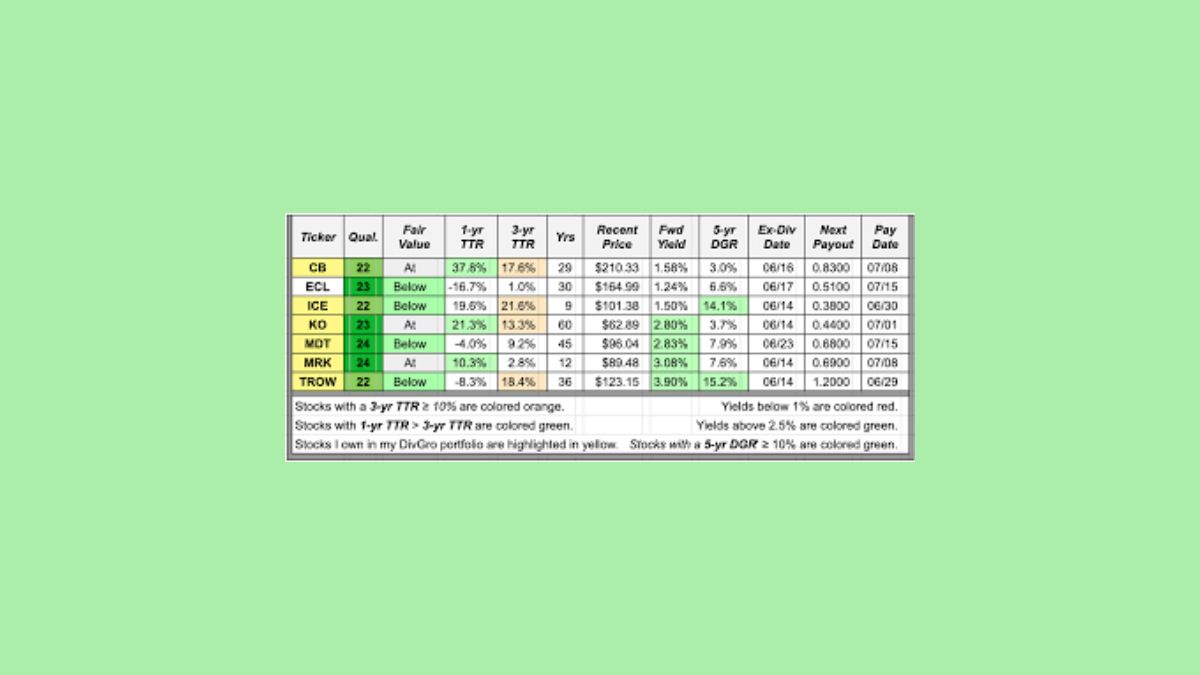

Welcome to the world of investing, where every date on the calendar holds a hidden treasure trove of opportunities. Today, we’re diving into the intriguing realm of SPY and its Spyi Ex-Dividend Date – a key event that savvy investors keep a close eye on. Get ready to unlock the secrets behind this important date and discover how it can impact your investment strategy. Let’s delve into the fascinating world of SPY Ex-Dividend Date together!

What is an Spyi Ex-Dividend Date?

Have you ever wondered what an Ex-Dividend Date really means when it comes to your investments? Let’s break it down in simple terms. The Spyi Ex-Dividend Date is crucial for determining who is eligible to receive a dividend payment from a stock. It’s the date set by a company where you must own shares in order to receive the upcoming dividend.

If you buy shares on or after the Ex-Dividend Date, unfortunately, you won’t be entitled to that particular dividend payment. However, if you own shares before this date, congratulations – you’re in line for some extra cash! Keep in mind that stock prices often adjust downward by the amount of the dividend on the Ex-Dividend Date as investors are essentially paying less for a stock without the upcoming dividend attached.

Understanding and keeping track of Ex-Dividend Dates can help you make informed decisions about your investment strategy and potentially maximize your returns.

How Does the Ex-Dividend Date Affect Investors?

Investors pay close attention to the Spyi ex-dividend date as it plays a crucial role in dividend investing. This specific date determines who is eligible to receive the upcoming dividend payment from SPY. When an investor purchases shares before the ex-dividend date, they are entitled to the next dividend payout. On the contrary, if shares are bought on or after this date, the investor will not receive the current dividend.

The impact of the Spyi ex-dividend date goes beyond just receiving dividends; it can also affect stock prices. Typically, share prices tend to drop by approximately equal to the amount of the dividend payment on this day due to market adjustments. This phenomenon is known as “dividend capture,” where investors may buy stocks right before and sell them right after to maximize profits from dividends.

Understanding how ex-dividend dates influence investments allows investors to strategize their buying and selling decisions effectively while considering both dividends and stock price fluctuations within SPY’s framework.

Strategies for Investing During the Ex-Dividend Date

As an investor, navigating the ex-dividend date can be a strategic move in maximizing your returns. One key strategy is to buy shares before the ex-dividend date to ensure you are eligible for the upcoming dividend payment. This approach allows you to capture the dividend while potentially benefiting from any price increase leading up to the ex-dividend date.

On the flip side, some investors may choose to wait until after the ex-dividend date to purchase shares at a potentially lower price. While this means missing out on the current dividend payment, it could result in buying at a discount and positioning yourself for future dividends.

Additionally, reinvesting dividends back into SPY can compound your investment over time through dollar-cost averaging. This strategy involves automatically reinvesting dividends to purchase more shares, ultimately increasing your overall holdings and potential returns.

Risks and Considerations for SPY Ex-Dividend Date

Investing in SPY around the ex-dividend date comes with its own set of risks and considerations that investors should be aware of. One key risk is the potential for a drop in stock price equal to the dividend amount on the ex-dividend date, which can lead to short-term fluctuations in the stock’s value.

Another consideration is that investing solely for dividends may not always align with your overall investment strategy. It’s important to evaluate whether chasing dividends fits within your long-term financial goals and risk tolerance.

Additionally, market conditions and investor sentiment can impact how SPY performs around its ex-dividend date. Sudden changes in market dynamics or economic factors could influence the stock price unpredictably.

Furthermore, liquidity concerns may arise as trading volume can fluctuate during this period, potentially affecting price movements. Being mindful of these risks and considerations can help you make informed decisions when navigating SPY’s ex-dividend dates.

Frequently Asked Questions about SPY Ex-Dividend Date

What are the benefits of investing in SPY on the ex-dividend date? Investing in SPY on the ex-dividend date can be appealing to investors looking to receive dividends without holding onto the stock for an extended period. This strategy allows investors to potentially capture a dividend payment while also benefiting from any price appreciation leading up to the ex-dividend date.

When is the best time to buy SPY before its ex-dividend date? The timing of purchasing SPY before its ex-dividend date can vary depending on individual investment goals and strategies. Some investors may choose to purchase shares well in advance of the ex-dividend date, while others may wait until closer to maximize their dividend yield.

How does the ex-dividend date impact SPY’s stock price? On the ex-dividedate, SPY’s stock price typically adjusts downward by approximatelythe amountofthedividendtobe paid outto shareholders.

This adjustment reflects that new buyers ofthesharewill notbeentitledto therecentlydeclareddividendsince theypurchasedtheshares aftertheex-date.

Conclusion:

As you navigate the world of investing, understanding the nuances of SPY Spyi Ex-Dividend Date can provide valuable insights into maximizing your portfolio’s potential. By knowing when this date occurs and how it impacts your investments, you can make informed decisions that align with your financial goals.

Whether or not SPY Spyi Ex-Dividend Date is right for you depends on various factors such as your investment strategy, risk tolerance, and overall objectives. It’s essential to conduct thorough research and consult with a financial advisor to determine if incorporating this date into your investment plan makes sense for you.

Remember, knowledge is power in the world of investing. Stay informed, stay proactive, and always strive to enhance your financial literacy. Happy investing!

GENERAL

Transform Your Insurance Experience with Cobb-Hall’s 24/7 Services

In a world where everything seems to be moving at the speed of light, having access to services that operate around the clock isn’t just a luxury—it’s a necessity. Cobb-Hall Insurance understands this need and has crafted a 24/7 service that is both comprehensive and user-friendly. Whether you’re a new customer exploring your options or a long-time client who needs immediate assistance, Cobb-Hall’s 24/7 service promises to revolutionize how you manage and interact with your insurance.

Why 24/7 Access Matters More Than Ever

The pace of life today demands services to be available when you need them, not just during regular business hours. Gone are the days when insurance queries or emergencies could wait. With Cobb-Hall’s 24/7 services, you’re assured of help and information anytime, whether it’s 3 AM or a holiday weekend.

Access to 24/7 services isn’t just about convenience. It’s about peace of mind. Imagine needing to report an incident, check your policy details, or even update your information after hours. With Cobb-Hall, these tasks are made seamless and stress-free. This round-the-clock availability ensures that your life doesn’t have to pause for insurance formalities.

Furthermore, being available 24/7 sets Cobb-Hall apart in a competitive market. It’s a commitment to customer service that goes beyond the norm, reflecting the organization’s dedication to meeting the evolving needs of its clients.

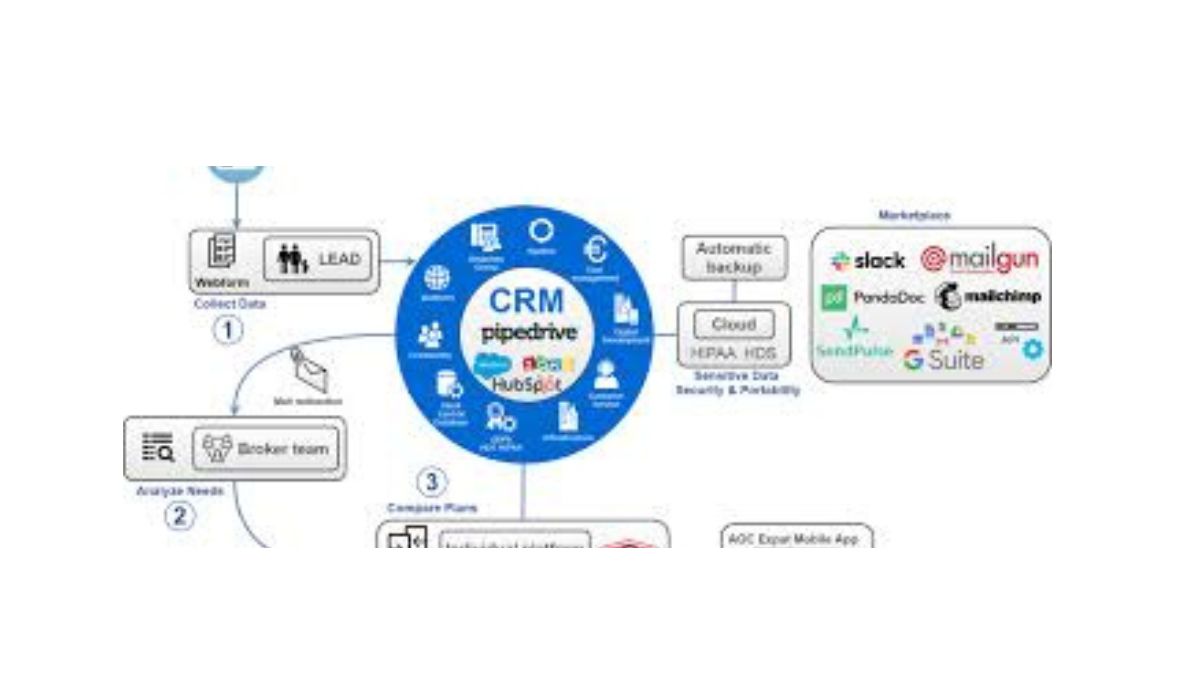

Understanding the Services Offered

Cobb-Hall Insurance’s 24/7 service isn’t just about having someone on the other end of a line. It’s about offering a comprehensive suite of tools and support options that cater to every possible need you might have regarding your insurance policies. This includes everything from claims processing to policy inquiries and updates.

The service allows clients to file claims at any hour, ensuring that the process begins promptly. This promptness can significantly affect the speed and efficiency of claims processing, ultimately leading to faster resolutions. It’s not just about convenience; it’s about getting results when they matter most.

Additionally, having 24/7 access means you can inquire about your coverage details anytime you need reassurance or clarification. It’s as simple as logging in or making a call, and you’ll have the information you need right at your fingertips. This immediacy can help alleviate concerns and provide peace of mind, knowing your coverage is continually accessible.

The Technology Behind the Service

Behind Cobb-Hall’s exceptional 24/7 service lies sophisticated technology designed to streamline operations and enhance user experience. Advanced digital platforms, supported by state-of-the-art security measures, ensure your interactions are not only efficient but also safe.

This digital infrastructure allows for seamless integration across various platforms, meaning you can access your account whether you’re on a smartphone, tablet, or desktop. The user-friendly interface ensures even those who aren’t tech-savvy can easily manage their policies and access services without a hitch.

Furthermore, the security protocols in place mean your data is protected from breaches and unauthorized access. This aspect is crucial in building trust, as clients can rest assured that their sensitive information remains confidential and secure, no matter when or where they’re accessing it.

How to Make the Most of 24/7 Access

While having 24/7 access is incredibly beneficial, knowing how to maximize this service is equally crucial. Start by familiarizing yourself with the online portal or app, if available. These platforms are designed to be intuitive, so take some time to explore their features.

Regularly updating your contact information and preferences can also enhance your experience. This proactivity ensures that all communications are timely and relevant, tailored to your needs and circumstances. It also helps in preventing any service disruptions or delays should you need to use the service urgently.

Lastly, don’t hesitate to reach out to customer support if you have questions about using the service. The staff at Cobb-Hall are trained to assist with any queries, ensuring you can utilize the full potential of the 24/7 access without any barriers.

Real-Life Scenarios Where 24/7 Access Saves the Day

Consider a scenario where a client experiences an accident late at night. With Cobb-Hall’s 24/7 service, they can immediately report the incident, initiate the claims process, and receive guidance on the necessary steps to take next. This immediate action can significantly alter the outcome and resolution time, reducing stress and uncertainty.

Another example might involve a client needing to review their policy details before making an important decision, such as purchasing a new home or car. The ability to access this information instantly, at any time, means decisions can be made with complete confidence and awareness.

Such scenarios illustrate how 24/7 access isn’t just a theoretical benefit but a practical tool that can make a real difference in people’s lives. It’s not just about being there; it’s about being there when it counts.

The Impact on Customer Satisfaction

Customer satisfaction is at the heart of any successful business model, and for insurance providers like Cobb-Hall, 24/7 access is a significant contributor to achieving high satisfaction levels. This service ensures that clients feel valued and supported whenever they need it, fostering a strong sense of loyalty and trust.

Feedback from clients who utilize the 24/7 service often highlights the convenience and reassurance it provides, particularly in high-stress situations. This positive perception can lead to higher retention rates and recommendations, which are invaluable for business growth and reputation.

In essence, by prioritizing customer needs and enhancing their experience, Cobb-Hall continues to set a standard in the industry, solidifying its position as a leader in client-focused insurance services.

Conclusion and Next Steps

Cobb-Hall Insurance’s 24/7 service is more than a convenience; it’s a commitment to providing exceptional support and accessibility to all clients. By leveraging this service, you’re not only ensuring your insurance needs are always met, but you’re also joining a community that values innovation, security, and customer satisfaction.

To further explore how Cobb-Hall can serve your insurance needs, consider reaching out to their customer service team or visiting their website for more information. Discover what 24/7 access can do for you and experience the difference that comes with uninterrupted support.

Your insurance matters. Choose a provider that understands that. Choose Cobb-Hall Insurance.

GENERAL

Elevate Your Celebration with Stunning Wedding Reception Centerpieces

When planning a wedding, every detail matters. Among the most defining elements of a memorable reception are the centerpieces. They set the tone, enhance the atmosphere, and reflect the couple’s personality. In this blog post, we will explore the world of wedding reception centerpieces, offering insights and inspiration for those planning a celebration in New York Times style.

The Importance of Wedding Centerpieces

Centerpieces are more than just table decorations; they are an essential component of your wedding Reception Centerpieces’s aesthetic. They serve as focal points and conversation starters, enhancing the ambiance of your reception. A well-designed centerpiece can transform a plain table into a work of art, creating a visual experience for your guests.

For couples aiming for a wedding that’s featured in the New York Times, centerpieces play a critical role. They capture the essence of the theme and add layers of elegance and sophistication. Every element, from the choice of flowers to the arrangement style, contributes to the overall impression.

Besides aesthetics, centerpieces also impact the functionality of the table. They must be beautiful yet practical, allowing guests to see each other and interact comfortably. Striking this balance is key to creating an inviting and enjoyable reception.Trends in Wedding Reception Centerpieces Centerpieces

The world of wedding centerpieces is constantly evolving, with new trends emerging each season. From minimalist arrangements to lush floral displays, the options are endless. One popular trend is incorporating natural elements, such as greenery and wood, to create an organic, earthy feel.

Another trend is the use of unique vessels and containers. Couples are opting for non-traditional options like terrariums, vintage vases, or geometric shapes to add a modern twist. These containers can enhance the centerpiece by adding texture and visual interest.

Color palettes are also playing a significant role in centerpiece design. Soft pastels, bold jewel tones, or classic whites—each choice sets a different mood. Experimenting with colors and textures allows couples to create centerpieces that reflect their personal style and wedding theme.

DIY Centerpieces vs. Professional Arrangements

Choosing between DIY centerpieces and professional arrangements depends on several factors, including budget, time, and creativity. DIY centerpieces offer a personal touch and are often more budget-friendly. They allow couples to infuse their personalities into every detail, creating unique and meaningful pieces.

However, DIY projects can be time-consuming and may not always yield the desired results. This is where professional florists come in. They have the expertise and resources to bring any vision to life, ensuring every detail is perfect.

For those with a clear vision and creativity, DIY projects can be fulfilling and fun. But for couples seeking a stress-free and polished look, hiring a professional might be the better option. It ultimately depends on the couple’s priorities and preferences.

Incorporating Personal Touches

Adding personal touches to your centerpieces is a wonderful way to make your wedding truly yours. Consider incorporating elements that reflect your hobbies, interests, or shared experiences. This could be anything from using books for a literary-themed wedding Re ception Centerpiecesto incorporating seashells for a beach-inspired celebration.

Personalized centerpieces not only enhance the theme but also create a more intimate and meaningful atmosphere. Guests will appreciate the thought and effort put into making the event special and memorable.

Consider using family heirlooms or handmade items in your centerpieces. These elements add a sense of nostalgia and connection to your loved ones, creating a unique and heartfelt experience foBudget-Friendly Centerpiece IdeasCreating stunning centerpieces doesn’t have to break the bank. There are plenty of budget-friendly options that can still make a big impact. One idea is to use seasonal flowers, which are often more affordable and readily available.

Another option is to mix high and low elements. Pairing lush blooms with simple greenery or using candles alongside minimal floral arrangements can create a luxurious look without the high price tag.

Repurposing items from home or finding treasures at thrift stores can also be cost-effective. Old glass bottles, mismatched china, or vintage trays can be transformed into charming centerpieces with a little creativity and effort.

Eco-Friendly Centerpieces

Sustainability is becoming increasingly important for many couples, and eco-friendly centerpieces are a great way to incorporate this value into your wedding Reception Centerpieces. Consider using potted plants instead of cut flowers, as they can be replanted or given as gifts after the event.

Opting for locally sourced and organic flowers supports local farmers and reduces the carbon footprint. Additionally, using recyclable or biodegradable materials for your arrangements is a step towards a more sustainable celebration.

Minimizing waste by donating flowers to hospitals or care homes after the wedding is another thoughtful way to make your event eco-friendly. These small choices can make a big difference in reducing the environmental impact of your wedding.

Seasonal Centerpiece Inspiration

Drawing inspiration from the seasons can result in stunning centerpieces that reflect the beauty of nature. For spring weddings, consider using an abundance of tulips, daffodils, and cherry blossoms to capture the freshness and vibrancy of the season.

Summer weddings call for bright, bold colors and tropical blooms like hibiscus and orchids. Incorporating fruits like lemons or limes can add a refreshing twist to your arrangements.

Fall weddings are perfect for rich, warm tones and textures. Incorporate elements like pumpkins, apples, or wheat for a rustic and cozy feel. Winter weddings can be elegant and sophisticated with white flowers, evergreen branches, and touches of silver or gold.

Centerpieces for Different Wedding Themes

Centerpieces should align with your wedding theme to create a cohesive and harmonious look. For a romantic wedding, soft flowers like roses and peonies in blush tones can create an ethereal feel. Incorporating candlelight adds to the ambiance.

For a modern wedding, sleek lines and minimalist arrangements work best. Consider using single stems in geometric vases or monochromatic color palettes to achieve a contemporary look.

A vintage-themed wedding Reception Centerpieces calls for nostalgic elements like lace, pearls, and antique containers. Incorporate flowers like hydrangeas, gardenias, and lavender to enhance the vintage charm.

Working with a Florist

Collaborating with a florist can be a rewarding experience, allowing you to create the centerpieces of your dreams. Start by sharing your vision and inspiration with the florist, providing as much detail as possible.

Discuss your budget and priorities, and be open to their suggestions. Florists have the expertise to recommend flowers and arrangements that align with your vision while staying within your budget.

Schedule a consultation to see samples of their work and discuss logistics. Communication is key to ensuring your expectations are met, and your centerpieces are everything you envisioned.

Centerpieces for Outdoor WeOutdoor weddings offer the beauty of nature as a backdrop, and your centerpieces should complement this setting. Consider using natural elements like branches, stones, or moss to enhance the outdoor vibe.

Choose flowers that withstand outdoor conditions, such as sun or wind. Hardy blooms like succulents, dahlias, and eucalyptus work well for outdoor settings.

Ensure your centerpieces are stable and won’t topple over in the wind. Weighted bases or low-profile arrangements can help keep everything in place.

Conclusion

The right centerpieces can elevate your wedding Reception Centerpieces reception from beautiful to unforgettable. They reflect your style, enhance your theme, and create lasting memories for you and your guests. Whether you choose to DIY or work with a professional, the possibilities are endless.

Remember, your wedding Reception Centerpieces is a celebration of love, and every detail should reflect that. Consider incorporating personal touches, staying within your budget, and being mindful of sustainability as you plan your centerpieces.

Ready to start planning? Explore our gallery for more inspiration and connect with our team for expert advice on creating the perfect centerpieces for your special day.

GENERAL

Yearbook 360: Revolutionizing the Way We Capture Memories

In the past, creating a yearbook involved long hours of collecting photos, organizing layouts, and waiting for prints to come back from the lab. The traditional process was time-consuming and often limited by design constraints.

Yearbook 360 has revolutionized this approach by offering a digital platform that streamlines the entire yearbook creation process. With Yearbook 360, schools can now easily collaborate online, access a wide range of design templates, and make real-time edits without the hassle of physical copies.

Gone are the days of worrying about misplaced photos or last-minute changes. Yearbook 360 enables schools to efficiently compile memories in a dynamic and interactive format that can be easily shared digitally or printed on-demand. This innovative tool not only saves time but also allows for more creativity in capturing unforgettable moments throughout the school year.

Benefits of Using Yearbook 360

Are you tired of the same old yearbook process? Yearbook 360 is here to shake things up and bring a breath of fresh air to how memories are captured.

One major benefit of using Yearbook 360 is the ease and convenience it offers. With digital tools at your fingertips, creating a personalized yearbook has never been simpler. Say goodbye to hours spent cutting and pasting – now you can design with just a few clicks.

Another advantage is the flexibility that Yearbook 360 provides. Whether you want to add videos, interactive elements, or collaborate online with your team, the possibilities are endless. Let your creativity run wild as you craft a truly unique keepsake for students.

Moreover, by going digital with Yearbook 360, you’re not only saving time but also reducing paper waste. Embrace sustainability while preserving memories in a modern way that resonates with today’s tech-savvy generation.

How to Use Yearbook 360

To use Yearbook 360, start by creating an account on the platform. Once logged in, you can begin designing your yearbook by selecting a theme that suits your school’s style. Customize each page with photos, quotes, and memories shared by students and staff. Utilize the easy drag-and-drop feature to arrange content effortlessly.

Invite contributors to add their own personal touch to the yearbook by granting them access to specific sections for collaboration. Review and edit pages before finalizing them for printing. Take advantage of the various editing tools available to enhance images and text for a polished finish.

Ensure all details are accurate before submitting your order for printing. Sit back and relax as Yearbook 360 brings your creation to life in high-quality print form or digital format for sharing online with classmates near and far.

Success Stories from Schools Using Yearbook 360

Schools across the country have been embracing Yearbook 360 to capture their students’ memories in a whole new light. From elementary schools to high schools, educators are thrilled with the results they’re seeing. One school in Texas reported that using Yearbook 360 not only saved them time and effort but also resulted in a more engaging yearbook that truly reflected their school spirit.

Another success story comes from a school in California where students took ownership of creating their yearbook with Yearbook 360’s user-friendly interface. The final product was filled with vibrant photos and heartfelt messages, making it a cherished keepsake for years to come.

In New York, a school shared how Yearbook 360 transformed their yearbook creation process by streamlining photo submissions and design layouts. The end result was a professional-looking publication that exceeded everyone’s expectations.

These success stories highlight the impact Yearbook 360 is having on schools nationwide, revolutionizing the way we preserve memories for generations to come.

Future Developments for Yearbook 360

As technology continues to advance, the future developments for Yearbook 360 are promising. One exciting possibility is the integration of virtual reality experiences into the yearbook creation process. Imagine being able to relive school events through immersive VR footage captured by students themselves.

Additionally, artificial intelligence may play a role in organizing and categorizing photos more efficiently, making it easier for users to search for specific memories within their yearbooks. This could revolutionize how we navigate through past moments and make them more accessible than ever before.

Furthermore, there might be increased customization options available in Yearbook 360, allowing schools to truly personalize their yearbooks with unique layouts, themes, and interactive features. The potential for collaboration tools that enable real-time editing among multiple users simultaneously could also streamline the creation process.

The future developments for Yearbook 360 hold endless possibilities that can further enhance the way we capture and cherish our memories.

Conclusion: The Power of Preserving Memories with Yearbook 360

Yearbook 360 is truly revolutionizing the way we capture and preserve memories. With its innovative approach to creating yearbooks, schools can now easily compile moments that reflect the essence of their community. The traditional yearbook process has evolved into a digital, interactive experience with Yearbook 360, offering benefits such as customization, ease of use, and efficiency.

-

FOOD10 months ago

FOOD10 months agoSure! Here are seven engaging blog post titles related to the concept of a “retail food product

-

GENERAL9 months ago

GENERAL9 months agoTroubleshooting Common VRChat Login Issues: Tips and Tricks

-

INSURANCE9 months ago

INSURANCE9 months agoNavigating the Future of Insurance with Technical Reserves in Flow Insurance

-

TECH9 months ago

TECH9 months agoDiscover Reliable Abithelp Contact Solutions with JustAnswer

-

FOOD10 months ago

FOOD10 months agoSure! Here are seven engaging blog post titles related to a “502 food blog

-

GENERAL11 months ago

GENERAL11 months agoExploring the World of Erothots: What You Need to Know

-

HEALTH10 months ago

HEALTH10 months agoMaine Health Jobs: A Comprehensive Guide

-

TECH5 months ago

TECH5 months agoWhat You Need to Know About the 346 Area Code